A well-diversified investment portfolio should serve the purpose of delivering optimal investment returns while managing risk.

If your investment portfolio is laden with shares (even listed property), then the returns required to meet your goals are exposed to the potential for increased volatility.

We believe traditional investment approaches that are centred around stocks and securities are unlikely to achieve the returns average investors will need to achieve all their financial goals because such strategies fail to capture the full investment potential available.

Increasingly, savvy investors are seeking diversified multi-asset strategies to capture new sources of investment returns to build their long-term wealth. This is a sound approach for when lower returns or increased volatility are experienced in financial markets.

While many investors favour either investing in shares or direct property investment, there is a growing chorus of investors that can see the benefits of investing in both.

Three major property investment options, with a focus on residential investment property

There are three major property investment types:

- vacant land

- commercial (including industrial and retail)

- residential

Both vacant land for subdivision and commercial property can offer great investment potential, though both require significantly more capital and expertise than is needed to establish a residential investment property portfolio. At Wealth Seekers, we favour a passive investment approach, historically, residential property has also offered the best market growth and rental stability. For these reasons, we’ve focused on residential property.

1. Property investing vs. Shares, and their respective capital growth potential

There’s a long-standing debate among Australian investors on whether property makes a better investment proposition than investing in stocks.

There’s always strong opinions about which option delivers the highest return, and short-term analysis of either investment class can favour one option over the other, depending on the period in question. However, according to a 20 year comparison across asset classes performed by Global Asset Manager Russell Investments, over the long-term, both enjoy comparable investment returns (Gross and After-Tax).

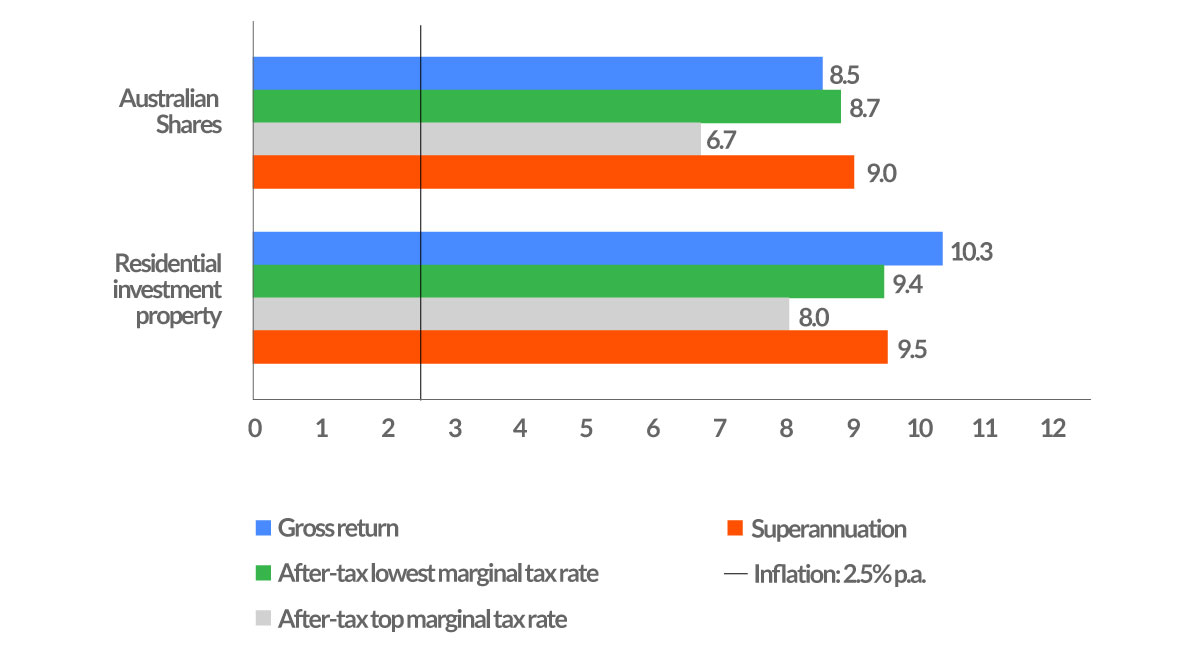

Graph 1.1: Before and after-tax returns over 20 years to 31 December 2016

Although shares have lower transaction costs and direct property investment enjoys higher borrowing margins, with both offering an investor comparable returns, which investment type proves most advantageous to an individual will depend on their financial position and their capacity.

The differences between property and shares, though, shouldn’t preclude an investor from considering investing in both, rather it should be seen as an opportunity to expand your portfolio with diversified investments where financial growth is driven by different underlying factors.

2. Property investment offers diversification

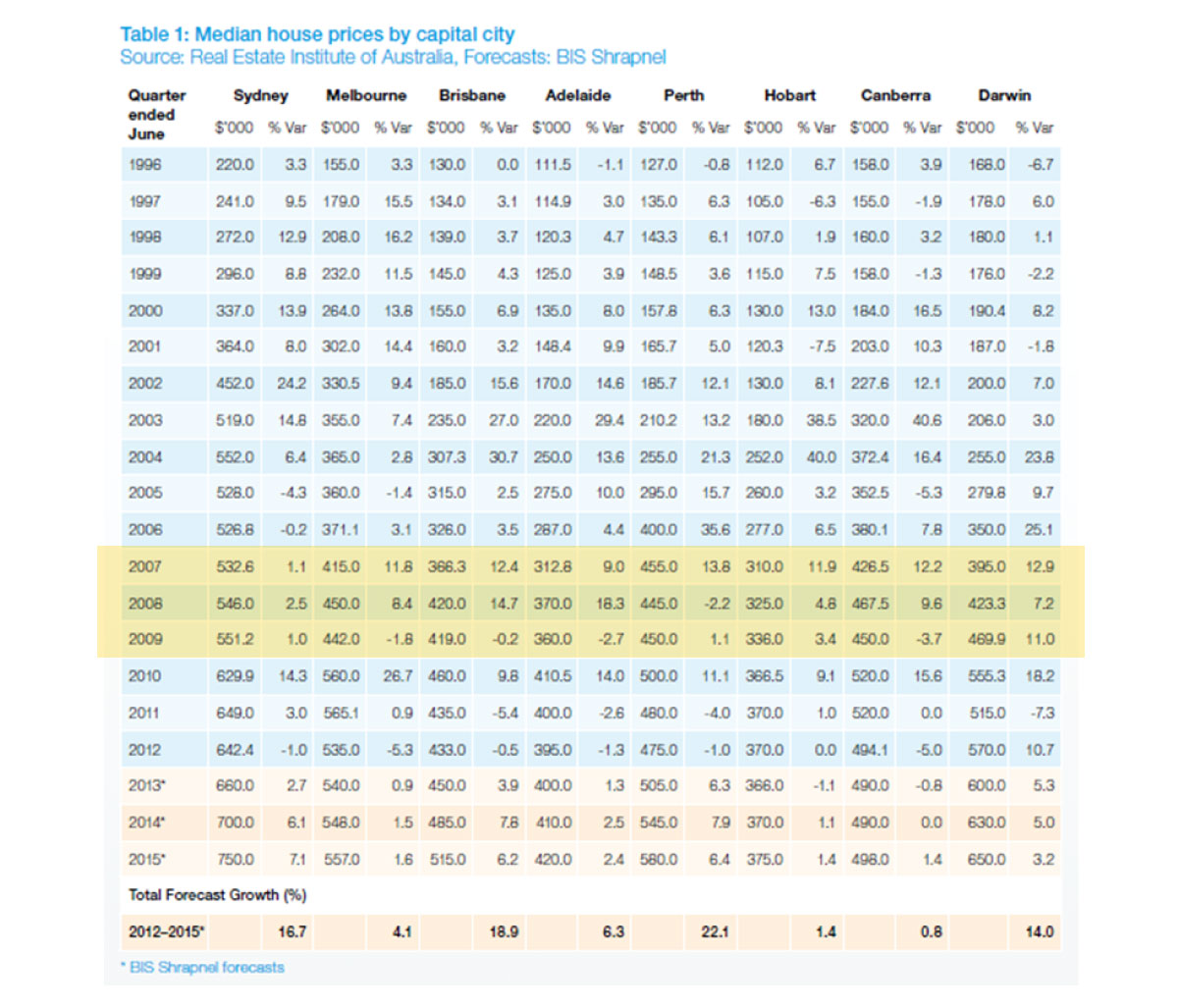

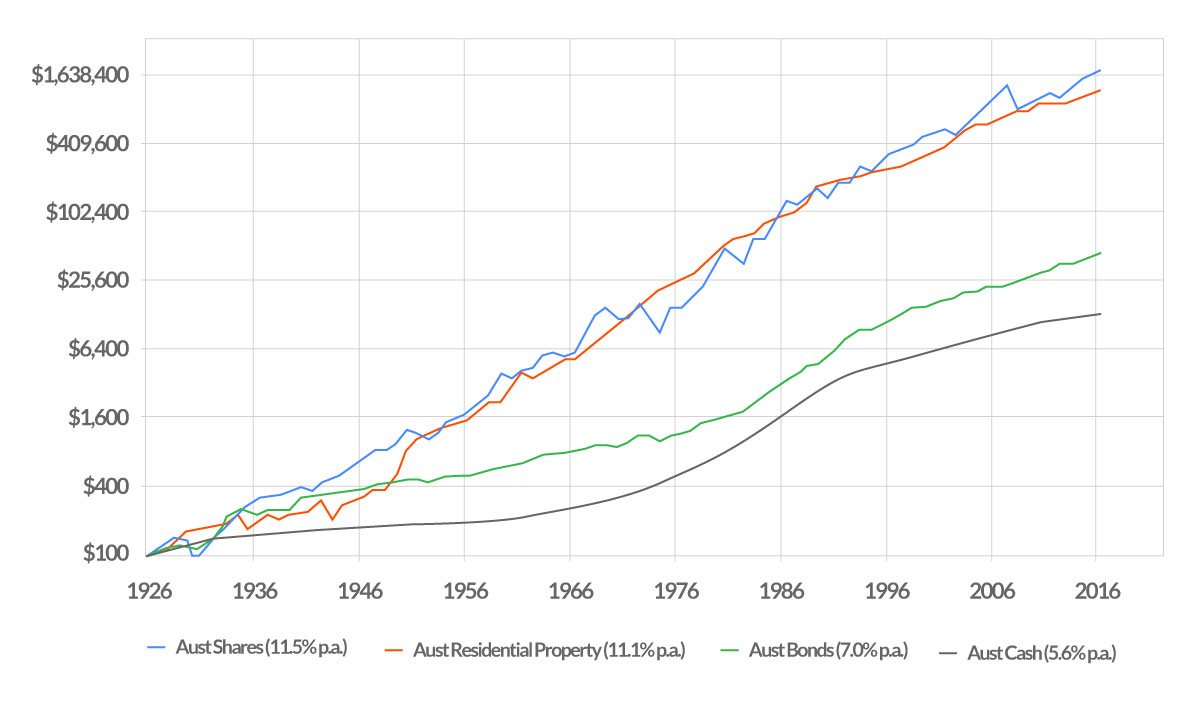

During the 2007 global financial crisis (GFC), the Australia share market dropped by approx. 54% from its peak in November 2007 to the lows reached in March 2009, whereas the median price for residential property in Australian capital cities weathered the GFC a lot better.

While a fund manager may seek to reduce the level of volatility for a share portfolio made up entirely of Australian Shares by including a mix global shares, the introduction of unlisted assets such as direct property can lower an investment portfolio’s volatility even more.

Historically, direct property has not been highly correlated with financial markets, so it can provide some measure of protection against falls in stocks and securities.

Graph 2.1: Various asset class correlations as measured against Australian equities

According to research house, Lonsec, unlisted growth assets such as direct property has a correlation coefficient of 0.03 compared with Australian equities (Shares).

Australian Super, along with other large industry super funds, have a long history of holding unlisted assets such as direct property and infrastructure in their members’ portfolios which provides steady, inflation-linked cash flows over the long-term.

3. Lower volatility when investing in property

The stability of direct property investment makes for a great long-term investment vehicle when borrowed money is required to complete the purchase, though sound property investment advice should be sought.

Unlike shares that can be bought and sold quickly, and as a listed asset, valued on a daily basis which causes greater volatility, property is much less liquid due to the size of the investment and the lengthy sales process. This results in less frequent transactions (valuing) and less volatile market swings than the stock market.

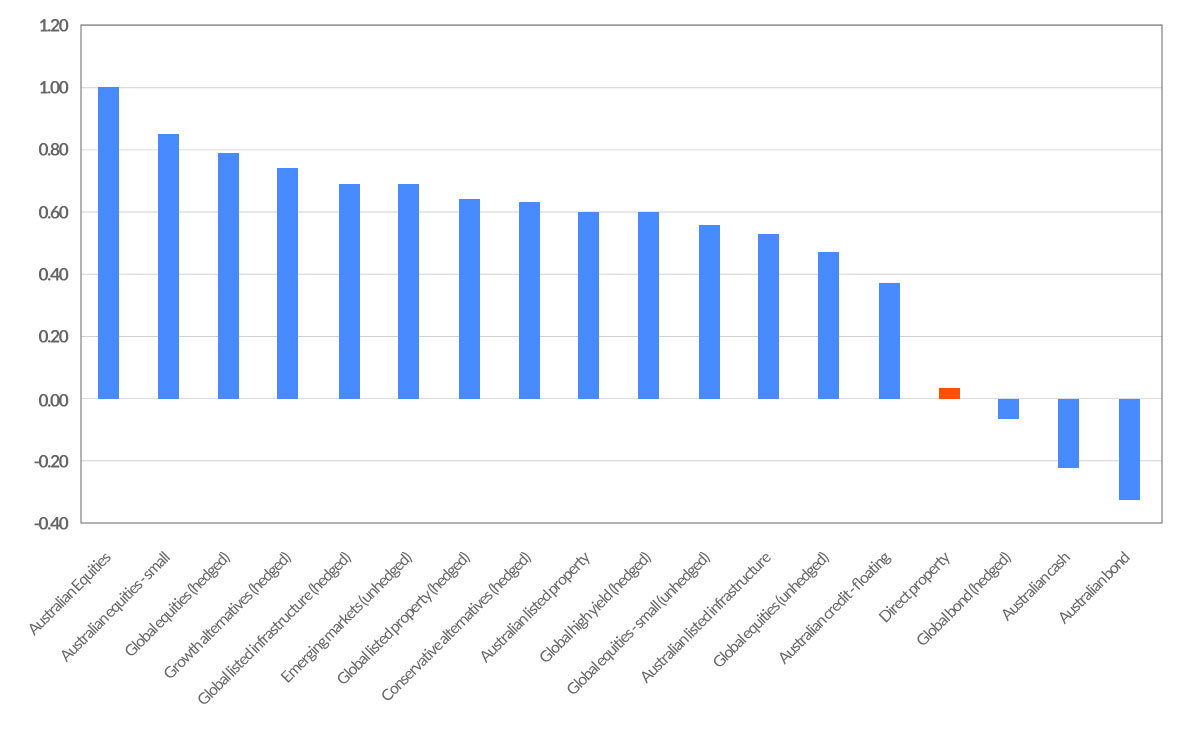

Although a property’s value can fall, the asset itself still remains, whereas a single share investment can be wiped out completely. Ryan Wood – Property Advisor Click To TweetGraph 3.1: Long term asset class returns compared

Source: ABS, REIA, Global Financial Data, AMP Capital Investors

Despite wars, disasters, recessions and a succession of crises since 1926, Australian property, according to research by AMP, has increased in value at a rate comparable to that of the share market– an average of 11.1% per annum. According to ASIC’s Moneysmart website, it has done so with less volatility than the share market, making it an all-round safer investment.

4. Greater Loan-to-Value-Ratio for Property Investment

Banks and institutions are very risk averse, so when lending money they want to know that the balance (plus interest) will be paid in full.

Comparing the Loan to Value Ratios (LVR) on property with shares, there are banks that will lend up to 95% of the value of a property, with LVRs below 80% avoiding LMI costs. The same banks will generally lend 0 – 70% on the value of shares, with LVRs on approved securities averaging 24% for account holders as of December quarter of 2017. Borrowing costs are also higher on margin loans than investment loans. Both are strong indicators that the risk weighting banks attribute to shares is greater than property.

With comparable returns expected from property and shares, and banks more willing to lend money for a property purchase at lower interest rates than shares – with borrowing involved, $100,000 would provide a larger investment in direct property.

It is also worth noting that banks will make margin calls when margin lending into shares, the same risks do not apply when investing in bricks and mortar.

5. Property Investment growth on larger invested amounts

With the ability to borrow to invest in property, and at a higher LVR than most other investments, there comes the benefit of earning capital growth on higher invested amounts.

The table below shows how two people in the same financial position (a property investor and a share investor) fare over 20 years.

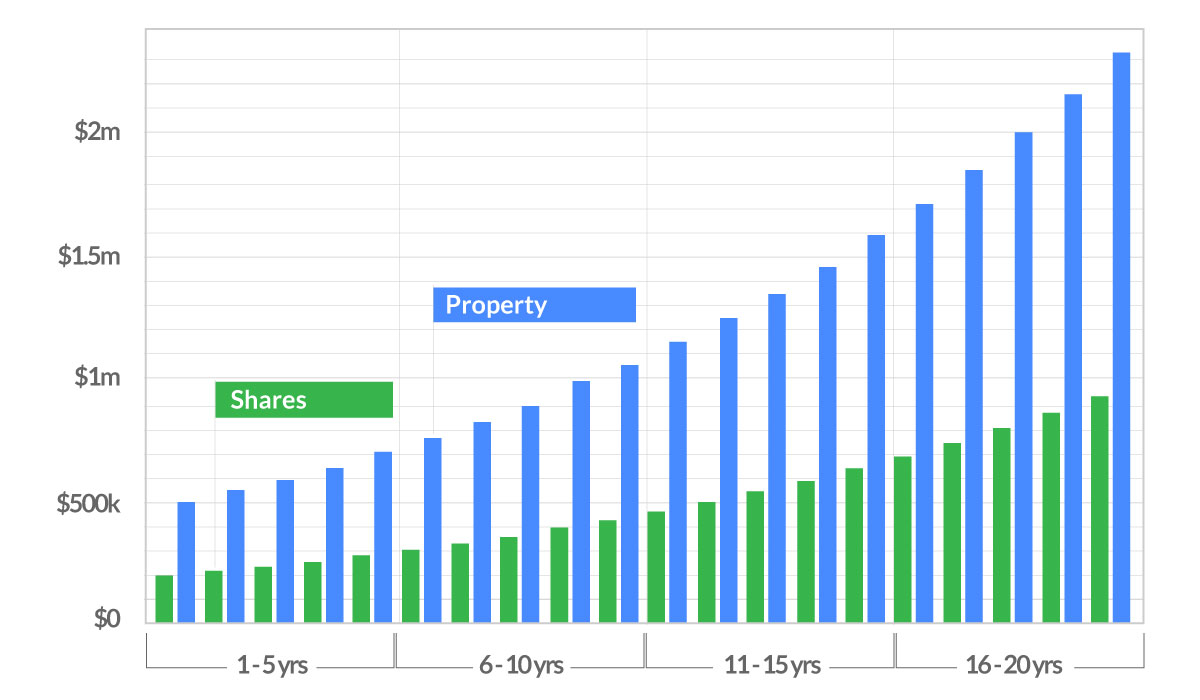

Graph 5.1: Comparison of $100,000 deposit used to invest in property vs shares

Actual figures have been used for a client who has a $100,000 deposit and bought an investment property for $500,000 (80% LVR) compared with another client who used his $100,000 deposit to secure a margin loan to invest in $200,000 (50% LVR) of shares with an average rate of return calculated for each at 8%.

The graph shows an initial investment in each and the compounding effect. It stands to reason that, if you utilised the capital growth on each to make further investments, then property would pull even further ahead than the capital growth on shares.

6. Capital growth on an investment property can be utilised without incurring a tax liability

As the value of your property investments increase, you may want to access that capital growth. This can be done by selling the property, where you will be subject to capital gains tax (CGT), or alternatively, you can borrow against the equity, usually up to 80% of the property’s value, and invest this money without incurring a CGT liability.

The amount of equity a lender will allow you to access on a property is generally up to 80% of its value. As the value of an investment property increases or the mortgage decreases, your LVR is reduced and a percentage of the equity becomes available to use as security for further borrowing.

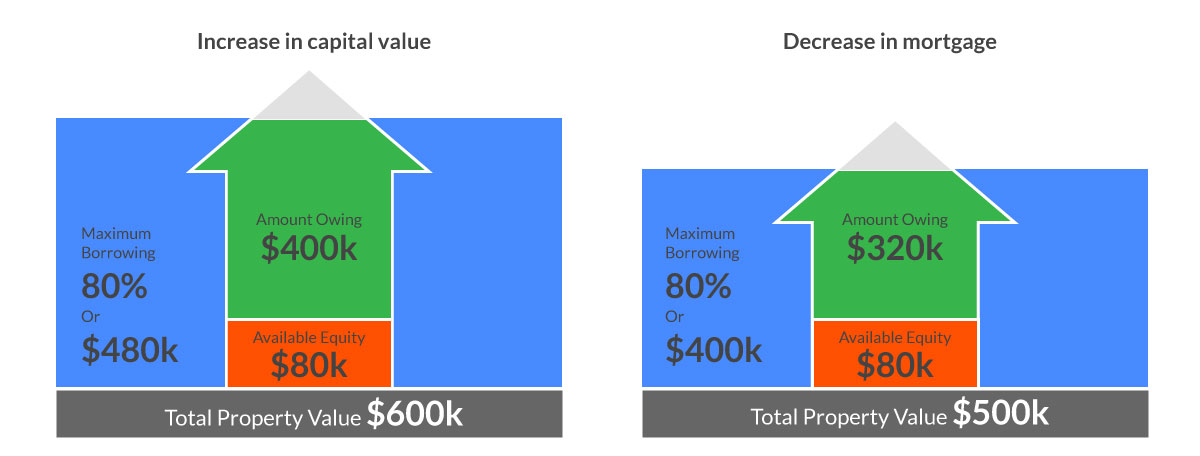

The graphic below shows how additional equity can be achieved from either an increase in the property’s value or a reduction in the mortgage.

Graph 6.1: Representation of the available equity in a property

For a property purchase of $500,000 with a $400,000 mortgage, the property’s value needs to increase to $600,000 or the mortgage reduced to $320,000 before $80,000 of equity is available.

As a long-term wealth generator, it is important to select a property with good growth potential and that appropriate financial analysis is performed in the first instance to ensure you can service the borrowing costs. Good property growth, coupled with a reduction in the property’s mortgage, can see you utilise equity for further borrowing to expand your investment portfolio.

7. There is the potential to improve the value of an investment property

Being a tangible asset, there is the option to improve the value of your investment property by renovating, extending or sub-dividing. Improving the property’s value in this way can increase the available equity and your net wealth. The challenge is to ensure that you do not over capitalise by incurring too many renovation costs which exceed the improved value of your property as this will reduce your net wealth.

Despite how simple the renovation shows on TV make it look, it does take experience and patience to ensure a renovation adds significant value to a property above the cost of the work involved.

8. An investment property is an income producing asset

An investment property should provide reliable rental income to support the property’s holding costs while you receive capital growth over time.

When borrowed money is used to make an investment, income along with any tax and government entitlements, plays a vital role in determining an investment’s affordability. Ryan Wood – Property Advisor Click To TweetWhen conducting your financial analysis on an investment, it is important to work with net incomes and appropriate buffers so that you can hold the investment for the long-term.

Property selection will be important as tenants will be providing the income, so you want to attract and keep good quality tenants. With the right investment property, your tenants can cover a large percentage of the holding costs.

9. There are tax benefits to investing in property

To further reduce the proportion of the holding costs which you may need to cover from your own pocket, there are tax benefits to investing in property that can assist you. The main tax benefits available to you are negative gearing and depreciation.

- Negative gearing is when the income from an investment property fails to meet the expenses of holding the property. The amount you are out-of-pocket can go to reducing your taxable income.

- Depreciation is the reduction in value of an asset over time (due to wear and tear). For property investments, the building can be depreciated, that is the building allowance (cost of construction) and plant and equipment (items in the building). Apart from the cost of a depreciation schedule, you don’t need to spend money to claim the deduction as it is classified as a paper loss only.

There are significant depreciation benefits when buying a new property, coupled with lower maintenance costs and improved tenant appeal.

It is important to note that your long-term investment strategy for property should be cash flow positive investment properties which enjoy strong capital growth – tax benefits alone should not be your reason for investing as they are really there to help support your holding costs.

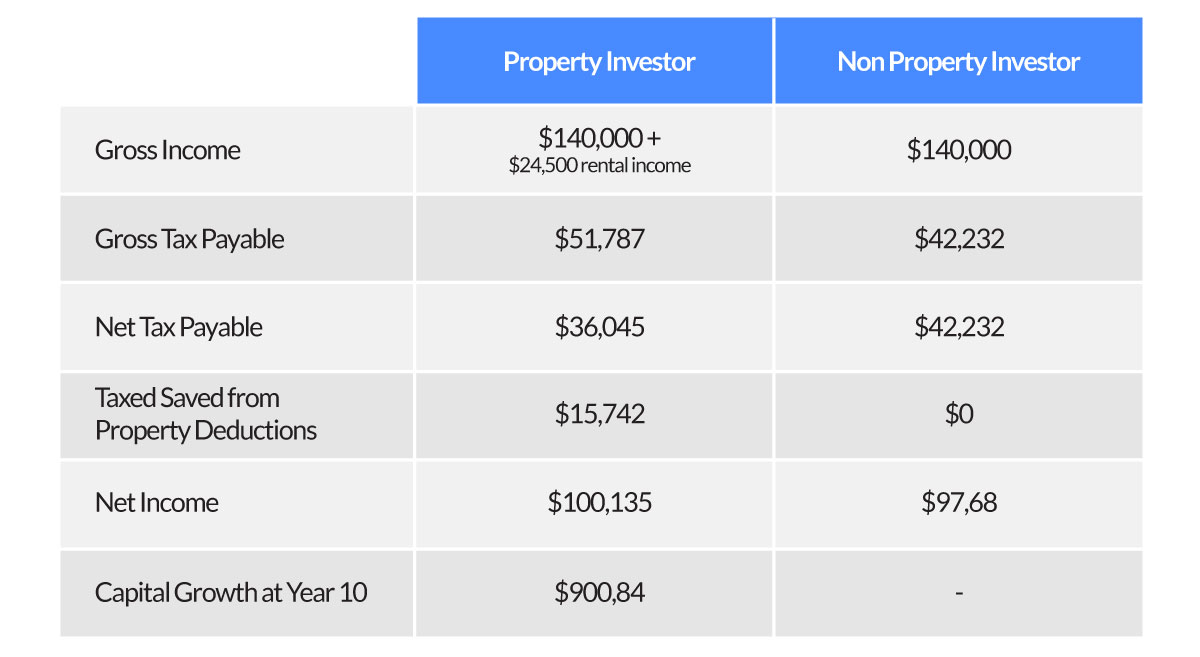

The table below shows how the tax benefits for a property investor can minimise holding costs while still enjoying capital growth over 10 years.

Table 9.1: Comparison of tax benefits for a property investor vs. non property investor

See how the holding costs are relatively low compared with the equity growth over time.

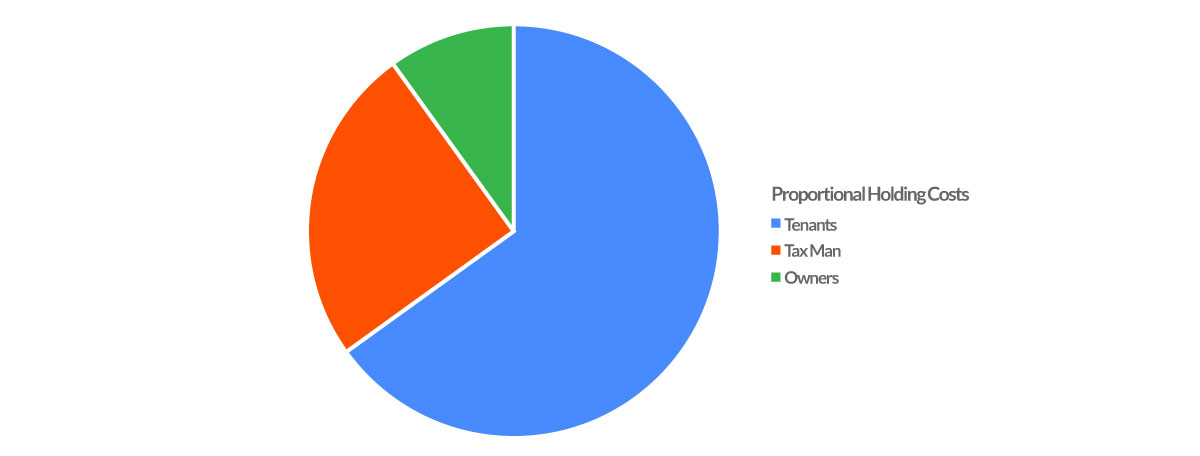

10. The combined income and tax benefits of direct property investment can reduce proportional holding costs

It’s no secret that landlords, not renters, get wealthy. The approximate holding costs for a good investment property should see you, the investor, pay the smallest proportion of those holding costs.

Utilising financial modelling tools can show you how much the tenants and the taxman is contributing to the holding costs of your investment property, through rental income, negative gearing and depreciation entitlements.

It’s not unusual to see scenarios where the investor is only funding a small fraction of the property with the tenants and taxman funding the rest.

Graph 10.1: Representation of potential proportional holding costs for a direct property investment

Conclusion

At Wealth Seekers, we consider that the difference between direct property investment and shares provides investors with the opportunity to diversify their portfolios in way that ensures investment growth is driven by different underlying factors.

Although both asset classes form important parts of a well-diversified portfolio, the greater stability of property, due to its tangible characteristics, means that investors can diversify their portfolios away from the volatility of financial markets while still enjoying comparable investment returns and increased tax efficiencies. The stability of the property market also enables investors to utilise the power of leverage in a more effective way to grow their portfolio over the long-term.

If you’re seeking to capture new sources of investment returns to build your wealth, direct property investment may provide you with an attractive option to improve your portfolio with a tangible asset which generates reliable, long-term rental income.

As with all investing, it is important to consider your portfolio as a whole and ensure that you have undertaken the appropriate financial analysis to determine if property investing is fit for your purpose and in line with your investment goals and objectives.