How does financial advice with Wealth Seekers work?

What we do…

Are you ready to organise your finances, grow your household wealth and begin building your ideal life? Here’s how we can help.

We create a tailored wealth plan for you

We go through your finances with you and create a plan for your money to reduce debt, grow your wealth and build your ideal life!

We do the work and save you time

We structure your finances, set up your investments, provide you the tools you need to achieve your goals and worry less about money.

We help you grow your personal wealth

Once your plan is up and running, you’ll stop wondering where your money goes and start seeing every dollar contribute to your wealth.

We teach you to be better with money

It’s easier to make good decisions about your future when you have visibility and control over your personal finances.

What we do…

Ready to organise your finances, grow your household wealth and begin building your ideal life? Here’s how we can help.

We create a tailored wealth plan for you

We go through your finances with you and create a plan for your money to reduce debt, grow your wealth and build your ideal life!We do the work and save you time

We structure your finances, set up your investments, provide you the tools you need to achieve your goals and worry less about money.We help you grow your personal wealth

Once your plan is up and running you’ll stop wondering where your money goes and start seeing every dollar contribute to your wealth.We teach you to be better with money

It’s easier to make good decisions about your future when you have visibility and control over your personal finances.What you get when you work with Wealth Seekers

With our help, you can organise your financial world, grow your household wealth and begin saving for your future

It’s much easier to navigate your financial world with a plan in place. We guide you through every aspect of your financial life, and we really enjoy explaining our methods and helping you to understand where your dollars are going.

Plan first, then action

When you partner with Wealth Seekers on your financial journey, you’re not just another number. We become part of your team and together we can achieve remarkable outcomes.

You define your goals and dreams, and we’ll give you the analysis and strategy to help you achieve them. We provide actionable advice with clean, clear, measurable results. You are in control but we’re always there to guide you.

A Wealth Plan that brings together your personal finances

In the financial world, results-driven strategies are comprised of many moving parts…

Savings / Budgeting System

Live well today while planning well for the future by structuring your money to ensure bills are paid, money is saved and investments are affordable.

Debt Reduction Plan

Get a professional financial analysis to make informed decisions about debt, and a proven strategy to help you organize and pay it off sooner.

Superannuation Plan

One of the biggest investments you’ll make in your lifetime. We help you get it right with a personalised, goals based plan to help you achieve your ideal retirement.

Insurance Plan

Designed to support your long-term goals, we ensure your financial assets are protected and your plan continues to work for you, even if your circumstances change.

Investment Plan

A long-term investment strategy is critical to growing your wealth. We identify the right mix of investment opportunities based on your goals and current situation.

Tax Minimisation Plan

We combine the expertise of a financial adviser and an accountant, who work together to manage your investments and your income sources to reduce tax.

Estate Planning

We develop a strategy to provides you and your loved ones with the peace-of-mind that your assets will be passed on to your beneficiaries in the most tax effective way.

Accountability + Support

We streamline your financial life and provide the tools & support to make measured financial decisions while ensuring that every dollar contributes to building your wealth.

Each area must align with the next and work together cohesively toward achieving your goals. We help you tailor the different areas of your finances to fit your unique financial circumstances, goals and objectives.

What you get when you work with Wealth Seekers

With our help, you can organise your financial world, grow your household wealth and begin saving for your future

It’s much easier to navigate your financial world with a plan in place. We guide you through every aspect of your financial life, and we really enjoy explaining our methods and helping you to understand where your dollars are going.

Plan first, then action

When you partner with Wealth Seekers on your financial journey, you’re not just another number. We become part of your team and together we can achieve remarkable outcomes.

You define your goals and dreams, and we’ll give you the analysis and strategy to help you achieve them. We provide actionable advice with clean, clear, measurable results. You are in control but we’re always there to guide you.

A Wealth Plan that brings together your personal finances

In the financial world, results-driven strategies are comprised of many moving parts…

Savings / Budgeting System

Live well today while planning well for the future by structuring your money to ensure bills are paid, money is saved and investments are affordable.

Debt Reduction Plan

Get a professional financial analysis to make informed decisions about debt, and a proven strategy to help you organize and pay it off sooner.

Superannuation Plan

One of the biggest investments you’ll make in your lifetime. We help you get it right with a personalised, goals based plan to help you achieve your ideal retirement.

Insurance Plan

Designed to support your long-term goals, we ensure your financial assets are protected and your plan continues to work for you, even if your circumstances change.

Investment Plan

A long-term investment strategy is critical to growing your wealth. We identify the right mix of investment opportunities based on your goals and current situation.

Tax Minimisation Plan

We combine the expertise of a financial adviser and an accountant, who work together to manage your investments and your income sources to reduce tax.

Estate Planning

We develop a strategy to provides you and your loved ones with the peace-of-mind that your assets will be passed on to your beneficiaries in the most tax effective way.

Accountability + Support

We streamline your financial life and provide the tools & support to make measured financial decisions while ensuring that every dollar contributes to building your wealth.

Each area must align with the next and work together cohesively toward achieving your goals. We help you tailor the different areas of your finances to fit your unique financial circumstances, goals and objectives.

STEP ONE

Call 1300 122 488

or enquire online

One of our friendly consultants will talk with you in confidence about your situation, answer your questions and book a free wealth consultation for you.

STEP ONE

Call 1300 122 488

or enquire online

One of our friendly consultants will talk with you in confidence about your situation, answer your questions and book a free wealth consultation for you.

STEP TWO

Meet your Wealth Expert

Our financial specialists are highly-trained. They are degree qualified with a Bachelor of Commerce and Advanced Diploma in Financial Planning. They are also professionally trained in investing, superannuation and money management.

More importantly, they genuinely care.

They’ll gather detailed information about your finances and create a customised wealth plan to start achieving your goals.

STEP TWO

Meet your Wealth Expert

Our financial specialists are highly-trained. They are degree qualified with a Bachelor of Commerce and Advance Diploma in Financial Planning. They are also professionally trained in investing, superannuation and money management.

More importantly, they genuinely care.

They’ll gather detailed information about your finances and create a customised wealth plan to start achieving your goals.

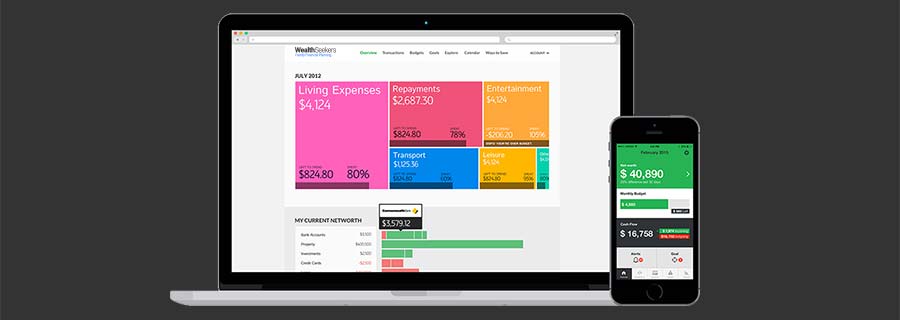

STEP THREE

Track your progress all

the way to the finish line

As a Wealth Seekers client, you have 24/7 access to your wealth plan via our secure members’ website and client app.

Just like a bank account, you can view your balance at a glance and search transactions. But here’s the notable difference – with Wealth Seekers you can also see all of your assets, investments, loans, savings, superannuation and financial goals in one place, along with the tools to track your progress toward your goals.

With the right financial tools and our support, you will have the confidence to make to make measured financial decisions and ensure every dollar contributes to building your personal wealth.

STEP THREE

Track your progress all

the way to the finish line

As a Wealth Seekers client, you have 24/7 access to your wealth plan via our secure members’ website and client app. Just like a bank account, you can view your balance at a glance and search transactions. But here’s the notable difference – with Wealth Seekers you can also see all of your investments, superannuation, goals and you can even track your progress toward your goals.

With the right financial tools and our support, you will have the confidence to make to make measured financial decisions and ensure every dollar contributes to building your personal wealth.

Get in touch and book your free consultation today!

Call 1300 122 488 today

Or

let us call you…

Why wait? Take control today. You’ve got nothing to lose. Our clients consider it one of the best decisions they’ve ever made. Fill out the form below and we’ll call when it suits you.

Why wait? Take control today. You’ve got nothing to lose. Our clients consider it one of the best decisions they’ve ever made. Fill out the form below and we’ll call when it suits you.

Frequently Asked Questions

How much does it cost?

A financial advisor will examine your financial position in detail during a free, no obligation consultation and create a plan for you that outlines your options to organise your finances, build wealth and achieve your financial goals. The plan we create is yours to keep for free at the end of the consultation – regardless of whether you become a client or not.

We charge an initial set up fee and an ongoing administration fee, these fees are accounted for in your plan. The fee will depend on the complexity of your needs and does vary from client to client.

We always quote upfront in a transparent fashion and will only proceed to the next steps if we can clearly identify an opportunity to significantly improve your financial position. The anticipated outcomes will always far outweigh the cost of implementing advice

How long does it take to get a plan in place?

From the moment you pick up the phone we start working on a wealth plan for you. You can see a Wealth Expert the next day and your wealth plan starts working for you as soon as you’re ready for us to start doing the legwork for you.

Why should I have a wealth plan?

We believe in planning first, then building. The planning process starts with an assessment of your objectives and your risks. The result of which is setting in place the appropriate structures that provide flexibility, manages risks, and ultimately puts you on the path to reaching your objectives.

When do I need to get started?

Most wealth building strategies are going to be based on the idea of compound growth – investing in assets which will grow in value over time. There will be two factors which directly control the end result – the rate at which the asset grows in value, which will be determined by the nature and choice of the asset, and the amount of time it is held, which will be determined solely by how soon you get started.

So getting started as soon as possible will lead to the best outcome, provided you have first taken the time to determine your goals and your strategy to ensure that the choice of assets is the most suitable for your Plan.

Why is the Wealth Seekers approach so successful?

Wealth Seekers strives to find a solution for every individual. Unlike a robo advisor, app or spreadsheet, our experts create a plan that’s specially designed to address your needs and priorities.

We also understand that the hardest part about financial change is seeing it through. That’s why we do the legwork for you. We can help you structure your finances, set up your investments and provide you with the tools to track your progress and stay on course to achieve your goals.

Succeeding is easier when you have a team of experts supporting you along the way!