Tax is the largest expense you’ll have over your lifetime. We all need to pay tax, but hidden within the tax you’re paying is money you don’t need to pay.

If you find savings in your tax, you’ll free up cash that can be invested in your future. It’s the simplest way to improve your lifestyle and increase returns on your investment portfolio.

Structure your finances to save

Tax planning is proactive. It involves looking at your entire financial situation and making sure every arrangement is as tax effective as possible.

At Wealth Seekers, we get the best possible results by combining the expertise of a financial adviser and accountant. Working collaboratively, they can manage your investment and income sources to legally reduce tax.

If you’re investing, we can help you minimise the ordinary income tax, long-term capital gains tax and short-term capital gains tax you pay. By looking at the big picture, we find savings that really add up.

Structure your finances to save

Tax planning is proactive. It involves looking at your entire financial situation and making sure every arrangement is as tax effective as possible.

At Wealth Seekers, we get the best possible results by combining the expertise of a financial adviser and accountant. Working collaboratively, they can manage your investment and income sources to legally reduce tax.

If you’re investing, we can help you minimise the ordinary income tax, long-term capital gains tax and short-term capital gains tax you pay. By looking at the big picture, we find savings that really add up.

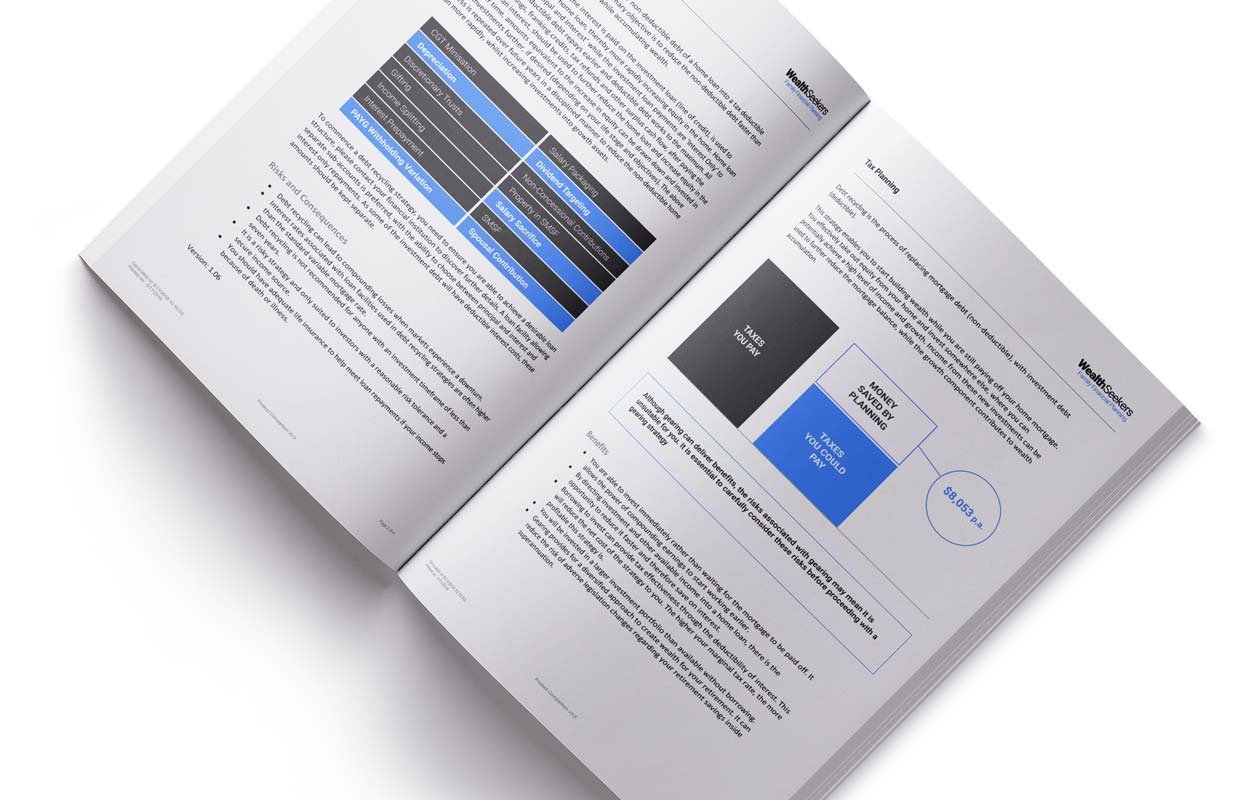

Reduce tax throughout your finances

Manage your money to reduce tax: Examine the flow of money throughout your finances to increase tax effectiveness.

Minimise capital gains tax: Hold onto investments for the long-term to minimise your tax liability and use equity to work toward your goals.

Take advantage of tax-free investments: Contribute to your superannuation and prioritise future tax-free investments.

Use every available option to legally reduce tax: Examine both investments and income sources to hold on to as much of your money as possible.

Reduce tax throughout your finances

Manage your money to reduce tax: Examine the flow of money throughout your finances to increase tax effectiveness.

Take advantage of tax-free investments: Contribute to your superannuation and prioritise future tax-free investments.

Minimise capital gains tax: Hold onto investments for the long-term to minimise your tax liability and use equity to work toward your goals.

Use every available option to legally reduce tax: Examine both investments and income sources to hold on to as much of your money as possible.

We can help you answer these questions:

Am I paying too much tax?

What are the tax implications of my investments?

Can my superannuation help me pay less tax?

When should I sell my investment to minimise tax?

We can help you answer these questions:

Am I paying too much tax?

What are the tax implications of my investments?

Can my superannuation help me pay less tax?

When should I sell my investment to minimise tax?