Home > Services > Superannuation Advice > Self-Managed Super Fund (SMSF) Advice > SMSF Property Advice

SMSF Property Investment Advice

SMSF can be a very tax effective way of investing in property and understanding how can have a significant impact on your overall wealth.

“When setting up our SMSF portfolio and property selection, Ryan took the time to drive us to various areas to help us make an informed decision. We also had a great lunch too and ad an opportunity to get to know each other. He explained all the paperwork and listened to our wants. I know Adrian and Ryan will always look after our best interests.” – Tracie Collura

SMSF Property Investment Advice

SMSF can be a very tax effective way of investing in property and understanding how can have a significant impact on your overall wealth.

“When setting up our SMSF portfolio and property selection, Ryan took the time to drive us to various areas to help us make an informed decision. We also had a great lunch too and ad an opportunity to get to know each other. He explained all the paperwork and listened to our wants. I know Adrian and Ryan will always look after our best interests.” – Tracie Collura

Property can be a great investment and our team can help you understand if it’s right for your SMSF

When it comes to self-managed super fund investment options, also known as an SMSF, property investing has been a popular choice.

An SMSF allows you greater control over which assets your superannuation is being invested into when compared to a traditional retail or industry fund.

While some choose to invest in riskier assets like cryptocurrencies or precious metals, real estate is one investment that will generally provide the income and capital growth returns required to secure your financial future.

Like many other aspects of setting up and running an SMSF, investing in property through an SMSF can be complicated.

There are benefits to holding property in an SMSF, including diversifying your superannuation investments in a way that doesn’t leave most of your superannuation balance exposed to the volatility of financial markets, however, there are rules governing what type of property you can buy and how it can be used.

In addition, their are fees and tax implications that can result from using your SMSF to purchase a property that don’t make property in SMSF suitable for everyone.

With all of these restrictions to consider, it can be easy to feel like you need professional help.

That’s where we come in.

Our team of accredited SMSF advisors are here to help you navigate every step of the process with the confidence that comes from knowing your financial future is secure.

Whether you’re considering commercial or residential property is the right investment for you or just want to know more about the risks and benefits that come with establishing an SMSF, we can help.

Property can be a great investment and our team can help you understand if it’s right for your SMSF

When it comes to self-managed super fund investment options, also known as an SMSF, property investing has been a popular choice.

An SMSF allows you greater control over which assets your superannuation is being invested into when compared to a traditional retail or industry fund.

While some choose to invest in riskier assets like cryptocurrencies or precious metals, real estate is one investment that will generally provide the income and capital growth returns required to secure your financial future.

Like many other aspects of setting up and running an SMSF, investing in property through an SMSF can be complicated.

There are benefits to holding property in an SMSF, including diversifying your superannuation investments in a way that doesn’t leave most of your superannuation balance exposed to the volatility of financial markets, however, there are rules governing what type of property you can buy and how it can be used.

In addition, their are fees and tax implications that can result from using your SMSF to purchase a property that don’t make property in SMSF suitable for everyone.

With all of these restrictions to consider, it can be easy to feel like you need professional help.

That’s where we come in.

Our team of accredited SMSF advisors are here to help you navigate every step of the process with the confidence that comes from knowing your financial future is secure.

Whether you’re considering commercial or residential property is the right investment for you or just want to know more about the risks and benefits that come with establishing an SMSF, we can help.

The benefits of buying property through your Super (SMSF)

Reduce your capital gains tax

A big bonus is if you hold on to your property investment until retirement the earnings within the pension phase are tax-free. That is on the rent earned if you keep the property or the capital gain tax you save on the sale of the property. (subject to the $1.6m pension transfer limit per member from 1 July 2017).

Gain full control over where your super funds are being invested

SMSFs provide you with more control over your money than any other type of superannuation fund. Not only can you invest in a broader range of asset classes, such as cash, fixed interest, direct property, shares, managed funds etc, you also have greater transparency with your investment strategy because you are able to see exactly what you’re invested into rather than receiving a statement every six to twelve months with a pie chart that depicts generic investments in various markets and asset classes.

Repayments are made from pre-tax dollars

If you can afford to save and have room within your concessional contribution limits then you can salary sacrifice additional income to super to pay off the loan quicker from pre-tax dollars. So paying 15% on salary sacrifice and then making additional repayments rather than paying your marginal tax rate on the income and saving it outside super.

Achieve a secure financial future by directly managing your super

As a trustee of an SMSF, you have a say in the direction the fund takes, from what investments the fund makes, to how much risk is taken, to how and when the returns made on those investments are withdrawn and shared among members.

How your superannuation is setup and managed is defined by you:

- Set your retirement goals

- Establish your investment strategy

- Select your investments

- Incorporate appropriate insurances

- Define your reporting requirements

- Review your performance and strategy annually

Secure better asset growth than traditional super funds

Your investments and the strategy that is guiding them will influence how much money you’ll have to retire on and how you live your life in your retirement years.

If you’re a member of a large fund then this process is normally done for you and you decide from a selection of investment options, such as Conservative (lower risk), Balanced or Growth (medium risk) and High Growth or All Growth (higher risk) investment options.

If you have a self-managed super fund, you’re able to establish an investment strategy that is tailored specifically to your retirement goals and better aligns with your risk profile.

An SMSF enables you to access a broader range of asset classes, including direct property. From a portfolio construction perspective, property falls within the category of “growth” assets. Growth assets tend to carry greater risk than defensive assets such as cash and fixed income. But has the potential to deliver higher returns over the long-term while also delivering greater tax efficiencies and better protection against inflation.

The limitations of buying property through your Super (SMSF)

Unable to purchase a property that belonged to a family member, friend or associate

Your SMSF is not allowed to buy a residential property from a fund member or any person associated to a fund member such as a relative. So if you or another fund member already own a residential property, you can’t transfer it into your SMSF.

An SMSF can, however, purchase listed shares or business real property (commercial and industrial) off a member.

Restricted from renovating your property in any way that dramatically alters it

You are allowed to repair and maintain an asset that is owned by an SMSF, but you cannot make capital improvements to any assets. For example, if you own an investment property in your SMSF and you have granite benchtops throughout your investment property that need replacing, you cannot put marble benchtops in place that are significantly more expensive and increase the value of the property.

It follows that you also cannot add additional bedrooms or put an extension on the back of your investment property while it is owned by your SMSF as all of these examples would amount to a capital improvement to the asset.

Prevented from purchasing a property with the sole aim to redevelop and resell it

If a property is demolished and say a duplex is built or land is initially purchased and then a separate contract to build is entered into then these are changes to the original asset and cannot be done within the SMSF while there is still an outstanding debt on the property.

Unable to have yourself or a loved one live in the property

All investments in an SMSF must meet the sole purpose test (i.e. they must be held in the fund for the sole benefit of your retirement) and this includes property investments. It follows that you cannot live or take holidays in a property that is purchased by your SMSF.

“I can highly recommend Wealth Seekers for anyone wanting to take control of their finances and/or set up a self managed super fund but don’t know where to start and want reassurance on the best way forward. From our first point of contact with Adrian and Ryan, we felt heard and confident we had chosen the right people and company to guide us through what we perceived to be a complex decision.” – Minda Lennon

The benefits of buying property through your Super (SMSF)

Reduce your capital gains tax

A big bonus is if you hold on to your property investment until retirement the earnings within the pension phase are tax-free. That is on the rent earned if you keep the property or the capital gain tax you save on the sale of the property. (subject to the $1.6m pension transfer limit per member from 1 July 2017).

Gain full control over where your super funds are being invested

SMSFs provide you with more control over your money than any other type of superannuation fund. Not only can you invest in a broader range of asset classes, such as cash, fixed interest, direct property, shares, managed funds etc, you also have greater transparency with your investment strategy because you are able to see exactly what you’re invested into rather than receiving a statement every six to twelve months with a pie chart that depicts generic investments in various markets and asset classes.

Repayments are made from pre-tax dollars

If you can afford to save and have room within your concessional contribution limits then you can salary sacrifice additional income to super to pay off the loan quicker from pre-tax dollars. So paying 15% on salary sacrifice and then making additional repayments rather than paying your marginal tax rate on the income and saving it outside super.

Achieve a secure financial future by directly managing your super

As a trustee of an SMSF, you have a say in the direction the fund takes, from what investments the fund makes, to how much risk is taken, to how and when the returns made on those investments are withdrawn and shared among members.

How your superannuation is setup and managed is defined by you:

- Set your retirement goals

- Establish your investment strategy

- Select your investments

- Incorporate appropriate insurances

- Define your reporting requirements

- Review your performance and strategy annually

Secure better asset growth than traditional super funds

Your investments and the strategy that is guiding them will influence how much money you’ll have to retire on and how you live your life in your retirement years.

If you’re a member of a large fund then this process is normally done for you and you decide from a selection of investment options, such as Conservative (lower risk), Balanced or Growth (medium risk) and High Growth or All Growth (higher risk) investment options.

If you have a self-managed super fund, you’re able to establish an investment strategy that is tailored specifically to your retirement goals and better aligns with your risk profile.

An SMSF enables you to access a broader range of asset classes, including direct property. From a portfolio construction perspective, property falls within the category of “growth” assets. Growth assets tend to carry greater risk than defensive assets such as cash and fixed income. But has the potential to deliver higher returns over the long-term while also delivering greater tax efficiencies and better protection against inflation.

The limitations of buying property through your Super (SMSF)

Unable to purchase a property that belonged to a family member, friend or associate

Your SMSF is not allowed to buy a residential property from a fund member or any person associated to a fund member such as a relative. So if you or another fund member already own a residential property, you can’t transfer it into your SMSF.

An SMSF can, however, purchase listed shares or business real property (commercial and industrial) off a member.

Restricted from renovating your property in any way that dramatically alters it

You are allowed to repair and maintain an asset that is owned by an SMSF, but you cannot make capital improvements to any assets. For example, if you own an investment property in your SMSF and you have granite benchtops throughout your investment property that need replacing, you cannot put marble benchtops in place that are significantly more expensive and increase the value of the property.

It follows that you also cannot add additional bedrooms or put an extension on the back of your investment property while it is owned by your SMSF as all of these examples would amount to a capital improvement to the asset.

Prevented from purchasing a property with the sole aim to redevelop and resell it

If a property is demolished and say a duplex is built or land is initially purchased and then a separate contract to build is entered into then these are changes to the original asset and cannot be done within the SMSF while there is still an outstanding debt on the property.

Unable to have yourself or a loved one live in the property

All investments in an SMSF must meet the sole purpose test (i.e. they must be held in the fund for the sole benefit of your retirement) and this includes property investments. It follows that you cannot live or take holidays in a property that is purchased by your SMSF.

“I can highly recommend Wealth Seekers for anyone wanting to take control of their finances and/or set up a self managed super fund but don’t know where to start and want reassurance on the best way forward. From our first point of contact with Adrian and Ryan, we felt heard and confident we had chosen the right people and company to guide us through what we perceived to be a complex decision.” – Minda Lennon

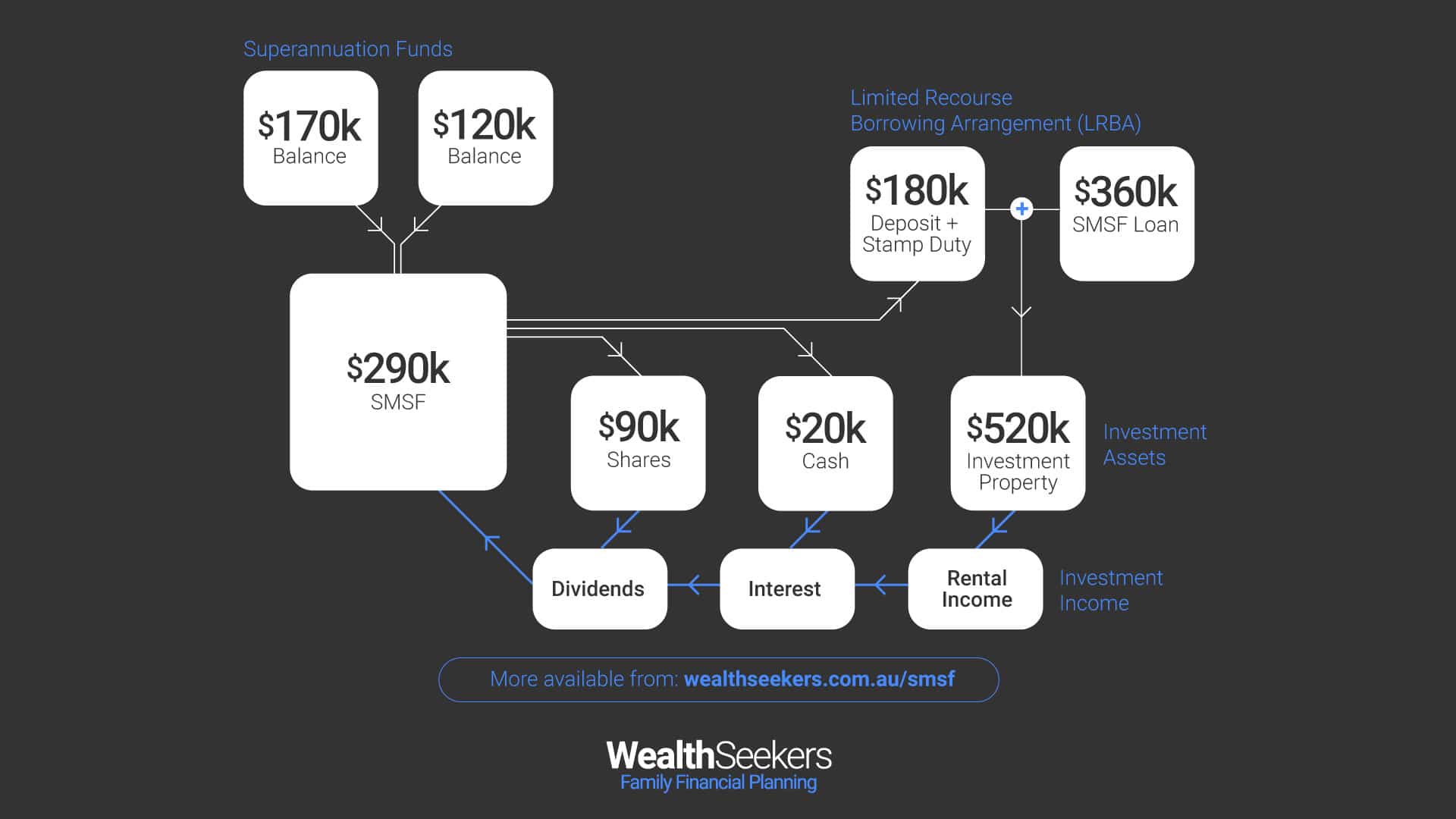

How Property Investing within an SMSF works

More About Using Your SMSF To Invest In Property

When compared with an investment property owned in your personal name, a property in SMSF enables you to:

- Invest in property with minimal to no disruption to your personal finances.

- It provides you with better enduring tax benefits as you reach retirement. Although the negative gearing benefits are reduced due to the low tax rate super environment, once you reach retirement and switch to pension phase, the rental income generated by your investment property is tax free, as are any capital gains realised on the sale of the property.

And when compared with traditional superannuation funds, an SMSF enables you to:

- Invest your superannuation money into assets that you feel more comfortable with, such as property.

- Diversify your superannuation investments in a way that does not leave the majority of your superannuation balance exposed to financial market volatility

- Borrow funds in your SMSF to increase the size of your investment portfolio (there are limits and rules you will need to meet).

- Move to a flat-fee structure, which means there is not a proportionate increase in the costs of running your SMSF as your superannuation grows, unlike the average industry or retail superannuation funds which charge a percentage-based fee.

- Utilise deductions from property expenses and depreciation write downs to potentially reduce the property holding costs to zero in the fund. It is possible to negatively gear in super while still maintaining a positive cash flow in your fund.

How Property Investing within an SMSF works

More About Using Your SMSF To Invest In Property

When compared with an investment property owned in your personal name, a property in SMSF enables you to:

- Invest in property with minimal to no disruption to your personal finances.

- It provides you with better enduring tax benefits as you reach retirement. Although the negative gearing benefits are reduced due to the low tax rate super environment, once you reach retirement and switch to pension phase, the rental income generated by your investment property is tax free, as are any capital gains realised on the sale of the property.

And when compared with traditional superannuation funds, an SMSF enables you to:

- Invest your superannuation money into assets that you feel more comfortable with, such as property.

- Diversify your superannuation investments in a way that does not leave the majority of your superannuation balance exposed to financial market volatility

- Borrow funds in your SMSF to increase the size of your investment portfolio (there are limits and rules you will need to meet).

- Move to a flat-fee structure, which means there is not a proportionate increase in the costs of running your SMSF as your superannuation grows, unlike the average industry or retail superannuation funds which charge a percentage-based fee.

- Utilise deductions from property expenses and depreciation write downs to potentially reduce the property holding costs to zero in the fund. It is possible to negatively gear in super while still maintaining a positive cash flow in your fund.

Find out if using your superannuation (SMSF) to invest in property is right for you?

We have an extensive process for determining your suitability for SMSF and providing professional support for tackling every step of the self-managed super fund process in a confident and compliant way.

Your team of financial advisors can help you:

- Decide which type of property will best suit your financial needs

- Understand how an SMSF will affect your financial plan

- Learn all the requirements involved in an SMSF property

- Decide whether an SMSF property is the right option for you

- Get answers to any and all of your questions

- Relax knowing your financial future is secure

At Wealth Seekers, we aim to empower you to walk your financial journey with the confidence that comes from knowing your financial future is secure.

Super forms a fundamental aspect of your overall financial plan, one that will help you to create your dream retirement.

Don’t let a lack of attention prevent you from reaching your short, medium and long-term financial goals.

Find out if using your superannuation (SMSF) to invest in property is right for you?

We have an extensive process for determining your suitability for SMSF and providing professional support for tackling every step of the self-managed super fund process in a confident and compliant way.

Your team of financial advisors can help you:

- Decide which type of property will best suit your financial needs

- Understand how an SMSF will affect your financial plan

- Learn all the requirements involved in an SMSF property

- Decide whether an SMSF property is the right option for you

- Get answers to any and all of your questions

- Relax knowing your financial future is secure

At Wealth Seekers, we aim to empower you to walk your financial journey with the confidence that comes from knowing your financial future is secure.

Super forms a fundamental aspect of your overall financial plan, one that will help you to create your dream retirement.

Don’t let a lack of attention prevent you from reaching your short, medium and long-term financial goals.

Want to invest in property through an SMSF?

Book your free appointment

Your team of professional financial advisors specialise in ensuring your super is positioned to help you create your dream financial future. We’re always in your corner, so you won’t have to go another minute with your questions unanswered.

If you are looking to use your superannuation to invest in property our financial advisors can help you track and stay on top of your funds.

Get in touch today to clean up your superannuation and ensure your financial future is secure.

“The team at Wealth Seekers played an important role in helping us look beyond the day to day bills and mortgage repayments, and understand what we can achieve if we set our sights on longer term goals. ” – Glyn Weatherall

Want to invest in property through an SMSF?

Book your free appointment

Your team of professional financial advisors specialise in ensuring your super is positioned to help you create your dream financial future. We’re always in your corner, so you won’t have to go another minute with your questions unanswered.

If you are looking to use your superannuation to invest in property our financial advisors can help you track and stay on top of your funds.

Get in touch today to clean up your superannuation and ensure your financial future is secure.

“The team at Wealth Seekers played an important role in helping us look beyond the day to day bills and mortgage repayments, and understand what we can achieve if we set our sights on longer term goals. ” – Glyn Weatherall

Want to know more about…

What support is required to setup and run an SMSF

Tax advantages to investing in property using an SMSF

Using your SMSF to invest in property has both benefits and limitations. With a team of experienced SMSF advisors in your corner, you’ll be able to navigate all of the fine details with confidence.

Want to know more about…

What support is required to setup and run an SMSF

Tax advantages to investing in property using an SMSF

Using your SMSF to invest in property has both benefits and limitations. With a team of experienced SMSF advisors in your corner, you’ll be able to navigate all of the fine details with confidence.

We’ll be with you every step when it comes to navigating the world of super funds.

We understand finding the right super fund for you can be a challenge.