Superannuation can offer a very tax effective means of investing in property. Understanding how it can be used, both before and after retirement, can have a significant impact on your overall wealth.

Superannuation can offer a very tax effective means of investing in property. Understanding how it can be used, both before and after retirement, can have a significant impact on your overall wealth.

“I really appreciated the support and help from the team at Wealth Seekers. Adrian explained things really well and went out of his way to help my situation. I felt confident that Wealth Seekers would help me sort out my superannuation and insurances and they did, consulting with me all the way.” – Jodie Crump

“I really appreciated the support and help from the team at Wealth Seekers. Adrian explained things really well and went out of his way to help my situation. I felt confident that Wealth Seekers would help me sort out my superannuation and insurances and they did, consulting with me all the way.” – Jodie Crump

SMSFs can be a very tax efficient property investment vehicle

SMSFs provide you with more flexibility around tax planning, and therefore as Trustee you can choose to structure and time your actions to pay as little tax as possible. This is a luxury that other super funds cannot offer.

Contributions into the superannuation fund are considered as income for the fund, and as such are liable for tax at a concessional rate of 15 per cent. For the retail and industry funds, the tax has to be deducted from the contributions before the money can be invested.

However, for the SMSF, the taxable income cannot be determined before the returns are prepared and lodged. This means that the contributions can be invested until such a time that the taxes are due. This means more money invested for longer, before tax is eventually paid.

SMSFs enjoy tax efficiencies from timing contributions to defer contributions tax, interest deductions from borrowing money and depreciation allowances when investing in property.

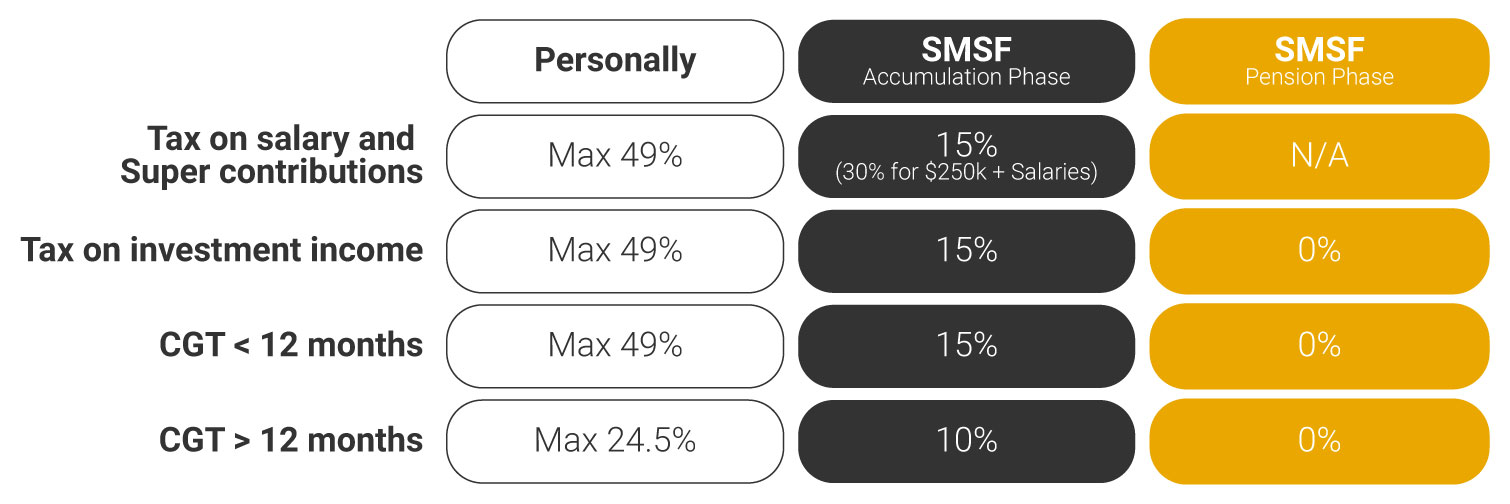

Personal tax rates vs. SMSF / Superannuation tax rates

Tax free when you reach retirement

A SMSF provides an advantage in the form of being able to hold off the sale of an asset until retirement, so that you can gain significant capital gains tax benefits. E.g. if you purchased an asset such as investment property before you retired for $400,000. Then, sold the property after you retired for $600,000, for super balances less than 1.6m you would not pay any capital gains tax. This means that the entire capital gain of $200,000 would be added to your retirement savings without paying any tax.

Important Note: Capital gains tax on traditional superannuation funds

In other funds, changing from a superannuation account to a pension account may involve the change of the superannuation trustee. When this happens, you are liable to pay capital gains tax. An SMSF does away with all this because switching from a superannuation accumulation account to a pension/retirement account within an SMSF does not involve change of trustee so there is no need to sell down assets prior to rollover and potentially triggering a CGT liability.

There are significant tax benefits that SMSF has when compared with traditional super funds. I recommend finding a good advice provider to help with the process.

Want to know more about Self-Managed Super Funds?

Self-Managed Superannuation Funds (SMSF)