Ongoing financial advisor fees can cost you over $421,952 or 19.53% in lost retirement savings, and even more if your financial advisor is not cost conscious with your investment selection and structuring.

Most people fail to realise there’s an opportunity cost involved with directing money out of their investment portfolio to pay financial advisor fees, and just as investment returns compound year-on-year, fees on investments have a compound cost year-on-year that can add up to a very large sum of money!

This article delves into the cost of ongoing financial advisor fees, what you should and shouldn’t be paying for, and how you can avoid paying more than you should. Short on time, click here for the Quick Summary .

Now, you might be thinking that paying your financial advisor 1% in ongoing advice fees is not all that much, but when stacked on top of product fees, platform fees and administration fees (see fee stacking below ), investment costs can add up to 2 to 3% being deducted from your investment portfolio each year.

The total cost of ongoing advice fees over time is staggering!

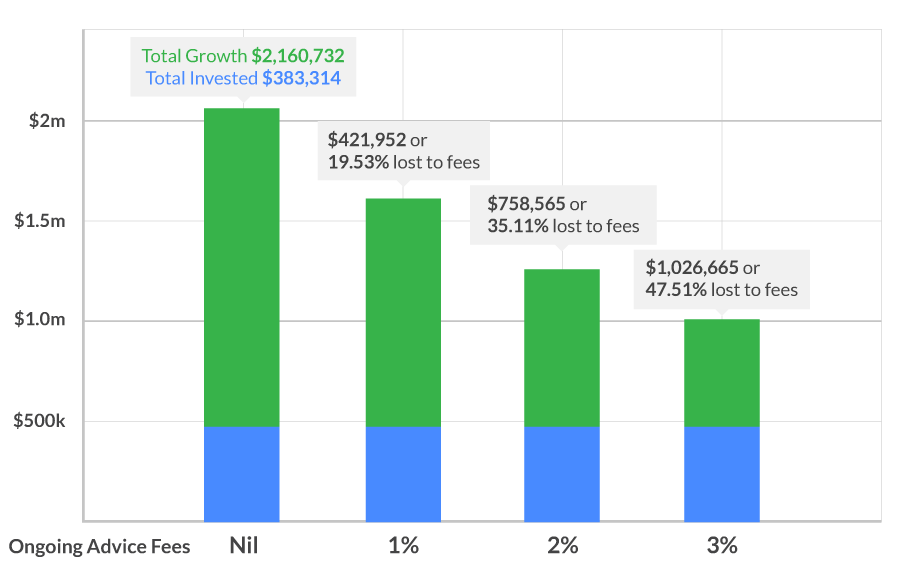

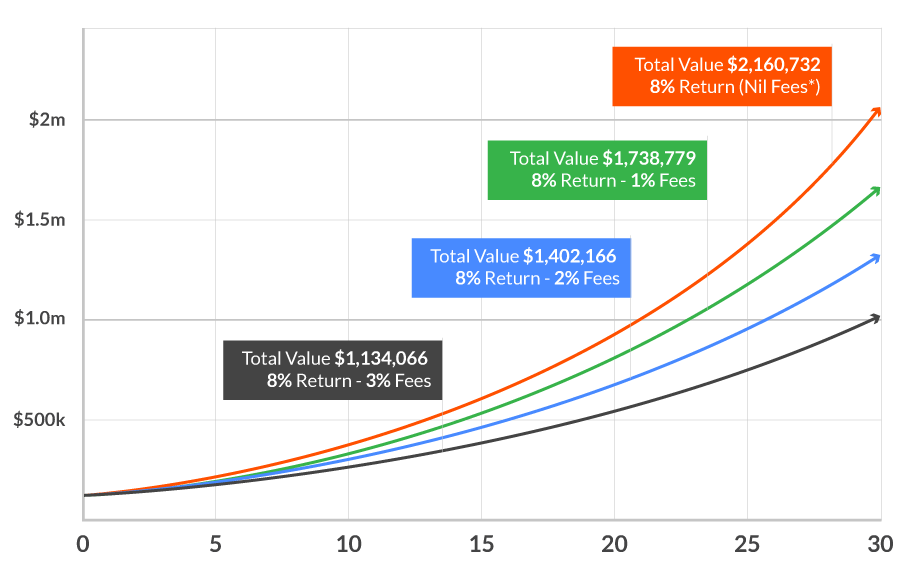

To examine the effect of investment fees, we looked at different ongoing percentage-based advice fees charged on the superannuation investments of a 35-year-old couple who have a combined balance of $113,464, contribute $8,995 to superannuation each year, earn an 8%* average annual return and plan to retire in 30 years. All comparison graphs and tables reference this data.

*Net of all fees and tax rebates except for ongoing financial advsor fees and their associated tax rebate

We used average superannuation account balances for a 35 year old male and female, sourced from The Association of Superannuation Funds of Australia October 2017 report, and contributions were based on 9.5% of the average Greater Brisbane family income sourced from the Australian Bureau of Statistics 2016 Census Quick Stats.

Graph 1: A comparison of the total costs of a 1%, 2% and 3% ongoing financial advisor fees on a 30-year investment (tax rebates included)

Note: You can use ASICs Money Smart Managed Funds Fee Calculator to determine the impact of percentage based fees on your investment portfolio over time

Burton Malkiel, author of the classic 1973 book, A Random Walk on Wall Street, and a key player in the founding of the index fund industry, noted in an op-ed piece: “The lesson for investors is very clear: You can’t control what markets do, but you can control the costs you pay”

As illustrated, for a 35-year-old couple, a 1% fee over 30 years can amount to $421,952 or 19.53% of their portfolio’s value. This could mean adding 5 to 10 years to your retirement date.

Adrian McPhee – Financial Advisor

Investment fees are inevitable, but some fees can be reduced, and others avoided altogether

There will always be costs associated with investing into productive asset classes that can grow your money. However, when you know the types of investment fees that you can incur, you can gain an understanding of which fees you can avoid, which fees you can minimise, and which fees are unavoidable. With this information, you then have the potential to save hundreds of thousands of dollars being wiped from your future personal wealth.

Would you pay your financial advisor $24,500 an hour for their time?

Last year, a family friend asked me to look at his finances. He’s in his 60s, worked hard his whole life, and accumulated a couple of million dollars to retire on across his personal finances and superannuation.

He’s had a financial advisor at one of Australia’s largest institutions for the past five years. I met him once, he seems like a nice guy. By all accounts, smart, able, honest, and competent. He put my friend in a basket of investments — mostly low-cost index funds, a few individual stocks, and a portfolio of bonds – to keep him on track to enjoy a comfortable retirement.

My friend is happy with his advisor. For the most part, I was, too.

There’s just one problem: My friend’s financial advisor fee is 1.1% on funds under management charged annually.

I’ve tried to explain to my friend on a few occasions how high this is, but my comments were met with a shoulder shrug. One and a bit percent didn’t sound like much to him.

But, when we added up how much he was paying his advisor every year, it was literally the single largest annual expense. More than his mortgage, more than his total food bill, more than he spent on travel, tech, entertainment, gifts, medical care, cars and schooling for his kids.

That got his attention, and so did this: In the past five years, my friend has spoken to his financial advisor seven times. When you break down how much he’s paid him, we figured out each meeting cost him $14,000 or almost $24,500 per hour.

Twenty-four thousand dollars per hour!

This is how traditional financial advisors operate.

An explanation of fees

When it comes to investing, whether it be your personal finances or your superannuation, costs will generally come in four forms:

- Financial advisor fees

- Product fees

- Administration fees

- Platform fees

These costs relate to investing and are separate from what you may be required to pay in tax or bank interest if there is borrowed money.

1. Financial Advisor Fees

Ongoing Financial Advisor Fees are Avoidable

Many Australian’s will seek advice from a financial advisor on how and where to invest their money. For this advice, a financial advisor will charge an advice fee.

There are generally upfront fees involved with receiving advice and implementing an investment strategy; however, provided that these fees are not excessive, these costs will usually be paid for many times over from the improved performance your finances should experience because of the advice you receive.

It is also common practice for financial advisors to charge an ongoing advice fee in addition to their upfront fees. At first glance, an ongoing fee can appear relatively insignificant, yet it can be extremely detrimental to the long-term growth of your investment portfolio (see table 1 below), especially when charged as a percentage of Funds Under Management (FUM).

Ongoing advice fees generally range between 1% to 2% of your portfolio, and even at the low end of the scale, they can be the equivalent of paying for a new financial plan every year when your finances, circumstances and goals haven’t changed, and no such plan is required.

Jo Bird, Senior Executive Leader, Financial Advisers at ASIC talks at length about financial advice fees for no service in ASIC’s Podcast.

2. Product Fees

Management Expense Ratio / Internal Cost Ratio are largely Unavoidable but certainly Reduceable

Management Expense Ratio (MER) or Internal Cost Ratio (ICR) is the fee you pay to the fund manager (e.g. Vanguard, Blackrock or Superannuation Fund) when you invest in a financial product such as a mutual fund, index fund, exchange-traded-fund or the ‘Balanced’ option in a superannuation fund. This can seem like an invisible fee, since it is deducted from the overall return on the investment, but, just remember, a 6.5% gain (tax rebates excluded ) would be an 8% gain were it not for a potential 1.5% deducted for fees.

An MER or ICR generally ranges from as low as 0.05% to as high as 2.5%, depending on which type of financial instrument you are investing in. Costs will differ between passive and active portfolio management with the difference in portfolio types being:

- At the low end of the scale are passively managed portfolios which seek to track an index and involve little management activity.

- At the higher end of the scale are actively managed portfolios which seek to beat the market (i.e. return alpha) and involve significant management activity.

To draw a relatable comparison between passive and active portfolio management:

Think of passive management as being like a visit to your mechanic for a scheduled log book service.

vs.

Active management which would be the equivalent of your mechanic scheduling regular visits to make several performance enhancements to your vehicle that result in an increase in your car’s performance along with a significant increase in costs above your scheduled servicing costs.

Interestingly, despite the increased costs of actively managed portfolios, actively managed funds are struggling to outperform index funds and ETFs that simply seek to track the market. And for those actively managed portfolios that do outperform their passively managed counterparts, they often only do this for a short period of time (one or two years) and the margin of improvement is nearly identical to the extra fees involved.

How you can avoid an MER/ICR altogether

An MER or ICR can be avoided, but it is generally not a cost-effective option. One way to gain exposure to financial markets and avoid an MER or ICR altogether is if you invest, for instance, in a diversified portfolio of direct shares. The problem with this type of investment approach is that it usually has:

- higher initial brokerage costs;

- higher ongoing transaction costs as you must regularly buy and sell securities to manage portfolio diversification;

- increased tax liabilities as you are consistently realising CGT events throughout the financial year;

- increased costs involved with having tax returns completed as your accountant will have more work to do; and

- higher advice and/or administration fees because there will be more professional work involved in advising on and/or processing changes to your portfolio.

3. Administration Fees

Administration fees can be Avoided or Reduced

Although platform fees (which are discussed below) can often be referred to as administration fees, for the purpose of this article, administration fees are those fees which are not necessarily tied to a specific investment platform or product, but instead are overarching fees paid by you to administer your investment portfolio. In this context, administration fees will generally be a flat cost rather than a percentage-based fee.

The two most common types of administration fees are:

- Office Administration Fees – An additional charge distinct from ongoing advice fees for things like processing paperwork or completing applications relevant to managing your investments. This fee is generally charged on an ad hoc basis and while it is important to be aware of, it’s not the intention of this article to delve into this type of fee any further.

- Self-Managed Superannuation Fund Administration Fees – The cost involved for administering your SMSF, including preparation of tax returns, financial reports, the external audit and handling compliance issues. When aggregated, these fees will cost approx. $2,500 p.a. and can represent a cost-effective option where large superannuation balances are held.

4. Platform Fees

Platform fees can be Avoided or Reduced

Platform fees are generally either percentage-based, a flat fee or a tiered fee. To put platform fees in context, they are basically the cost of using the platform through which you make your investments.

Common investment platforms you may be familiar with are:

- Share Trading Platforms – Commsec is a popular platform and allows you to deposit money into a Commsec trading account and purchase shares. There is generally no ongoing cost to hold funds in this type of platform, but you do pay brokerage costs per transaction (buy or sell). See ‘How you can avoid an MER/ICR altogether ’ for the issues you may encounter with using this type of investment account.

- Wrap Accounts – Combines all your cash, listed securities, managed funds, shares and insurance into one platform. The benefit of a Wrap account is it reduces some of the administrative burden and paperwork that usually comes with managing several individual investments separately and it can give you access to wholesale investment prices, but you do pay a platform fee (often called an administration fee) for a Wrap account which is usually percentage-based. It should be noted that Wrap accounts are sometimes used by retail superannuation funds (e.g. BT Super Wrap), but such accounts must be held separately from a Wrap which is held in your personal finances.

- Industry and Retail Super Funds – Majority of working Australians will have a superannuation fund. Performance between funds will vary as will fees. Although most Industry and Retail Super Funds will have a platform fee of some description (often called an administration fee), there are some super funds available which do not charge a platform fee and the only fee you’ll pay is your product fees (e.g. MER or ICR).

- Self-Managed Superannuation Funds – As indicated above, SMSFs will have an accounting cost for administering the fund, but an SMSF itself will not have a platform fee per se. However, see ‘Fee stacking on SMSF portfolios ’ for an explanation of the situation where bad financial advice can lead to you paying a platform fee inside your SMSF in addition to the accounting cost for administering the fund.

Percentage-based platform fees generally range from as low as 0.1% to as high as 1% while flat fees or tiered fees can be anything from less than $100 per annum to thousands of dollars per annum.

As indicated, it is possible to avoid platform fees as some investment platforms don’t charge them at all, but such platforms usually have relatively simple features and they lack the functionality and/or options of more advanced platforms. Depending on the type of investments in your portfolio, however, a platform with simple features and zero ongoing fees may be the most suitable for you to utilise.

Entry Fees, Exit Fees, Contribution Fees, Rollover Fees, Switching Fees, Performance Fees etc.

These types of fees are particularly insidious because they are designed to profit from transactions in your investment account or from years where above average performance is achieved. It’s not the intention of this article to delve into entry fees, exit fees, contribution fees, rollover fees, switching fees or performance fees etc. in detail; however, consideration of these fees should form part of the due diligence process when establishing an investment portfolio.

An informed financial advisor with a good moral compass will be aware of which platforms have these types of fees so that you can avoid paying them altogether.

Financial Advisors and the fee stacking problem

The problem faced by a lot of investors is that they’re paying fee piled upon fee piled upon fee!

The fees listed above are not charged in isolation of one another. Your investments can be exposed to advice fees, administration fees, platform fees and product fees all at once which can significantly erode financial growth.

Fee stacking on investment portfolios

It’s important to realise that, on an investment portfolio, most financial advisors will charge an ongoing advice fee on FUM which stacks on top of your MER/ICR and your platform fees.

This means that you are paying three separate fees to maintain your investment portfolio and it generally leads to the situation where you are paying anywhere from about 1.25% to 2% for a passively managed portfolio and 2% to 3% for an actively managed portfolio.

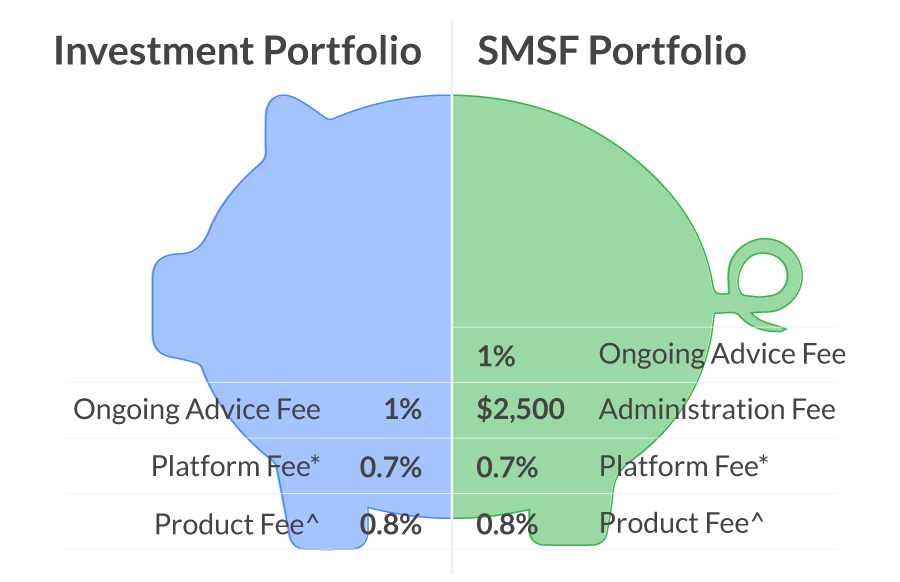

Fee stacking on SMSF portfolios

There are even instances where some advisors will provide their clients with advice to set up an SMSF and, as part of this advice, they will recommend for a Wrap to be held inside the SMSF. In such a scenario, the client is potentially paying four separate types of fees all stacked on top of each other – ongoing advice fee, MER/ICR, platform fees and SMSF administration fee.

*Platform fee is calculated on an average of four major Wrap account providers

^Product fee is a conservative MER calculation taken from the 2017 CANSTAR rated managed funds

The most egregious part of the SMSF portfolio scenario outlined above is that, with the right advice, two out of the four fees are completely unnecessary, yet how is a client supposed to know this if their financial advisor is telling them otherwise?

The wealth reducing impact of investment fees and ongoing financial advisor fees

Percentage-based fees constantly grow

The more money you have, the more money you pay. Not because your financial advisor or the fund managers are doing anything more for you than they were when your portfolio was half the size, but you pay more in fees simply because you have more money. And this means that the dollar amount you pay in fees grows exponentially as the value of your portfolio increases.

Now, the growth of a portfolio could be seen as a reflection of the value of the advice provided; however, in most instances, in addition to capital growth, you’re likely contributing to your investment portfolio each year in the form of dollar-cost-averaging and/or superannuation contributions. Your contributions are in no way a reflection of the value of the advice or the performance of the fund, yet they are often relied upon in your financial advisor’s calculations to justify the investment fees you are being charged.

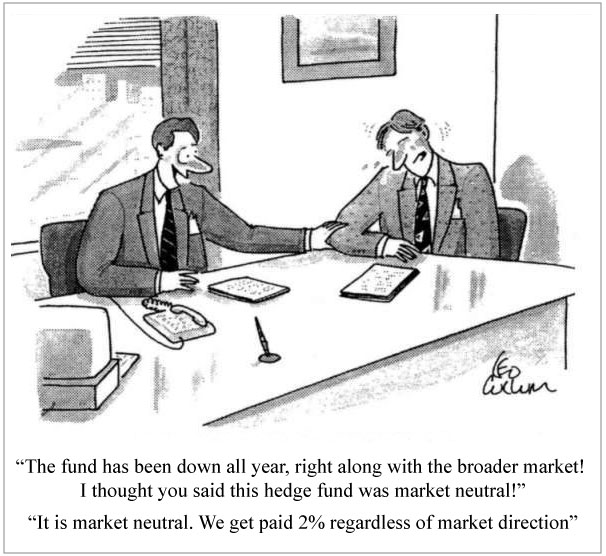

Ongoing financial advisor fees are still charged on negative investment returns

Many financial advisors will tell you that charging a percentage-based ongoing advice fee on FUM gives them a stake in your success. It’s call aligning their interests with yours, yet it’s important to realise that in no way is your financial advisor sharing the same risk as you. If the value of your investment portfolio falls, you are exposed to the reduction in investment value and you’re still required to pay your financial advisor’s fees. The only downside for your advisor is that the ongoing advice fee will incur a slight reduction as it is calculated on your lower investment balance.

The compounding cost of investment fees

Not only does the numerical amount of fees grow as your portfolio grows, but the compounding cost of the fees becomes ever more expensive. It’s important to recognise that, for instance, while a 1% fee may seem rather innocent, it does not mean you end up with 1% less at retirement than you would otherwise have had if you had not had to pay the fee in the first place.

Graph 2: The impact of 1%, 2% and 3% total ongoing advice fees on a superannuation investment portfolio over 30 years (tax rebates included)

*Net of all fees and tax rebates except for ongoing advice fees and their associated tax rebate

If your superannuation portfolio grows on average by 8% each year and you’re paying 1% in ongoing advisor fees, then you’re actually paying 12.5% (tax rebate excluded) of your annual growth in fees. And then there’s the compounding cost (i.e. the lost opportunity) of this fee which amounts to 19.53% net of taxes (or $421,952) of your total portfolio’s value lost to fees over a 30-year investment period (see table 1 ).

The true cost of ongoing fees accelerates over time

Obviously, the longer you have until retirement, the more money you begin with, the more money you contribute each year to your retirement savings, the higher your average investment return and the higher the fees you are paying will all impact on your retirement position.

Yet, regardless of when you begin investing, there’s an opportunity cost associated with taking money out of your portfolio to cover fees. Because percentage-based fees paid year-on-year are calculated as a percentage of the portfolio’s value, the larger the portfolio, the more an investor pays.

The following table illustrates just how the true cost of ‘avoidable’ ongoing advice fees accelerate over the life of an investment:

Table 1: Value of our 35-year old couple’s superannuation investment portfolio and the impact of a 1% ongoing advice fee over time (tax rebates included)

“Where a financial advisor seeks to justify their ongoing advice fees as a tax deduction, over 30 years where the total gross value of your investments lost in superannuation to a 1% fee would be 22.12%, your tax rebate on this fee would only represent a 2.59% total saving.”

Sunny Ramesh – Paraplanner

Even though the investor continues to get the same 8% average annual return, our analysis shows the percentage of value lost to fees climbs higher as the years pass. In this example, from 20 years to 40 years, the loss in value to fees increases from 13.37% to more than 25%. Over the course of 40 years, an additional 1% fee comes to a staggering $1,215,722 in lost value.

The increase in costs of a growing portfolio should be a warning to all current investors to pay close attention to their fees. For new investors, with the right financial advice, you can minimise the impact of investment fees from the beginning.

The hidden cost of ongoing fees

Above and beyond the pure financial cost of fees, there is also the hidden cost that comes with paying unnecessary fees, and that cost comes in the form of a drain on your confidence.

Human nature being what it is, the more progress we make with something in a shorter amount of time, the more engaged we become with it and the more motivated we are to become increasingly proactive in the pursuit of a goal. Progress reinforces and legitimises our efforts, gives us confidence to strive even further and ultimately propels us to achieve more and more.

Perhaps nowhere is this more prevalent than with our finances, so having unnecessary fees act like a veritable ball and chain which stifles growth can take a huge hidden toll on your financial progress and severely limit your potential wealth at retirement.

The Costs of Ongoing Financial Advisor Fees – Quick Summary

1. The total cost of ongoing advice fees over time is staggering!

Over 30 years, paying 1% of avoidable ongoing fees can total just over 19.5% (or $421,952) of your retirement balance and paying 2% of avoidable ongoing fees can total just over 35% (or $758,565) of your retirement balance (see example ).

2. Investment fees are inevitable, but some fees can be reduced, and others avoided altogether

- Ongoing Advice fees are avoidable (see how )

- Product fees are largely unavoidable but certainly reducible (see how )

- Administration fees can be avoided or reduced (see how )

- Platform fees can be avoided or reduced (see how )

If your financial advisor is not cost conscious with your investment selection and structuring, or if you are unaware what you should be paying for a well-diversified investment portfolio, the fees on your investments may end up being your single largest annual expense (see a story about the advisor earning twenty-four thousand dollars per hour ).

3. Financial advice and the fee stacking problem

A lot of investors are paying fee piled upon fee piled upon fee! When you know the types of investment fees that you can incur, you can gain an understanding of which fees you can avoid, which fees you can minimise, and which fees are unavoidable. This can potentially save you hundreds of thousands of dollars being wiped from your future personal wealth.

4. Ensure your financial advisor is not stacking unnecessary fees on your investment portfolio

Most financial advisors will charge an ongoing advice fee on your Funds Under Management (FUM) which stacks on top of your product fees and your platform fees. This can mean you are paying three separate fees to maintain your investment portfolio.

5. Ensure your financial advisor is not stacking fees on your SMSF portfolio

In some instances, clients can be paying four separate fees to maintain their SMSF portfolio – an ongoing advice fee, product fees, platform fees and SMSF administration fee. With the right advice, two out of the four fees are completely unnecessary.

6. Ensure your contributions are not being used in your financial advisor’s calculations to justify the investment fees you are being charged

The growth of a portfolio could be seen as a reflection of the value of the advice provided; however, you’re likely contributing to your investment portfolio each year in the form of dollar-cost-averaging and/or superannuation contributions. These contributions are in no way a reflection of the value of the advice or the performance of the fund, yet they are often relied upon in your financial advisor’s calculations to justify the investment fees you are being charged.

7. Ongoing financial advisor fees are still charged on negative investment returns

If the value of your investment portfolio falls, you are exposed to the reduction in investment value and are still required to pay your financial advisor’s fees.

8. There is a compounding cost to investment fees

If your superannuation investment portfolio grows on average by 8% each year and you’re paying 1% in ongoing advisor fees, then you’re paying 12.5% (tax rebate excluded) of your annual growth in fees. The compounding cost (i.e. the lost opportunity) of this fee amounts to 19.53% net of taxes (or $421,952) of your total portfolio’s value lost to fees over a 30-year investment period (see table 1 ).

9. The true cost of ongoing fees accelerates over time

Even when an investor continues to get the same 8% average annual return, our analysis shows the percentage of value lost to fees climbs higher as the years pass. In the example provided, from 20 years to 40 years, the loss in value to fees increases from 13.37% to more than 25%. Over the course of 40 years, an additional 1% ongoing fee comes to a staggering $1,215,722 in lost value (see example ).

10. Tax deductions on ongoing advice fees and investment fees do not represent a significant saving over a time

Where a financial advisor seeks to justify their ongoing advice fees as a tax deduction, over 30 years where the total gross value of your investments lost in superannuation to a 1% fee would be 22.12%, your tax rebate on this fee would only represent a 2.59% total saving.

Things to look for and ways to protect yourself

Although you can’t avoid paying fees altogether, there are things you can do to protect yourself to ensure that you’re not paying unnecessary fees and, indeed, that the unavoidable fees you are paying are at least minimised:

- Conduct regular audits on your investment portfolio and identify which fees can be avoided and which fees can be reduced. This should be done annually or when account statements arrive.

- If you’re paying an ongoing financial advisor fees and you think they’re excessive, you need to ask yourself what your financial advisor is doing each year to earn this money? Seek clarification from your advisor and ask for a rebate as well as a significant reduction in all future fees if you’re not satisfied with the outcome.

- If you’re paying an ongoing advice fee, you should receive a fee disclosure statement each year setting out exactly what you’re paying and what service you’re getting for what you’re paying. Consider whether it is your contributions that are adding real value to your investment portfolio or the services that your financial advisor is providing.

- If you’re paying an ongoing advice fee, every 2 years you will have to actively opt-in to continue your ongoing advice fee arrangement. Again, take this opportunity to review the value your financial advisor is providing for the fees you are being charged.

- If you feel like you might have paid fees for services in the past that you didn’t actually receive, you might be entitled to a refund and compensation. And you should, as a first point of call, lodge a complaint through the bank, financial institution or the AFS Licensee’s internal dispute resolution system. And if you don’t get satisfaction there, you should go to the Financial Ombudsman Service (FOS).

- If you are unsure of the fees you are currently paying to your financial advisor, as recommended by ASIC, ask your advisor for an aggregate report of all the fees you’ve paid throughout the year. Be prepared for a deal of prevarication from your advisor. Dig your heels in, though, and be firm. But, just remember, you need to be quite specific here because some advisors will interpret this request very selectively. You need to tell your advisor that you want to see:

- advice fees;

- product fees;

- administration fees (including SMSF administration and external audit costs if your SMSF is administered by an accountant who is connected to your financial advisor’s office);

- platform fees; and

- regulatory fees and charges related to your investment strategy.

- If you have a Wrap account or an index fund inside an SMSF, then you should ask your advisor why you are paying a platform fee for benefits, such as ease of accounting, when you are already paying for an accountant to prepare the financial statements and do the tax return for your SMSF? It is likely your investments have been structured this way to simplify things for your financial advisor at an additional cost to you.

- Get a second opinion. Most financial advisors will offer an initial consultation at no cost to assess your financial circumstances, and they’re usually only too happy to sit down with you to examine what you’re paying your current advisor to see if they’re able to get a leg up on the competition. If you do decide to change to another financial advisor, ask him or her for a full fee comparison to see exactly how much you’ll be saving each year before making a change to your existing advice arrangements.

Conclusion

Investment costs are only one area you should be considering when making investment decisions. It is important to think carefully about what you hope to get from an investment service or product and whether that benefit is worth the fees involved.

Trying to reduce fees at the expense of having a well-balanced portfolio with exposure to a diversified mix of asset classes in both domestic and international markets can be just as detrimental to your financial growth as excessive fees.

The fact remains, if you are paying unnecessary and/or excessive fees, you need to earn a higher investment return to achieve the same after-fee investment value (or standard of living in retirement) than you otherwise would with a low-cost alternative.

If your financial goals can be achieved with an appropriately structured mix of low-cost investments (potentially at a lower risk weighting), then not only are you getting better value for money, but you are also able to achieve your financial goals with a less risky investment strategy.

Thank you for this article. It hits the mark in terms of where I see the financial advice fee issues at this time. I have a Super lump sum under management in a Wrap account (old fashioned option apparently). Only recently did I uncover the set of ‘extra’ fees being charged, in addition to the advisor fee. I dont have a need to contact my Advisor often yet he charges a flat annual fee…whether the portfolio is negative or positive. I have tried to negotiate a fee on the basis of actual hours expended by the advisor which has been fruitless. Its a heck of a problem as last years return was effectively negated by the fees! Where to turn????

Hi David, I’m glad the article struck a chord with you. Where to turn? We’d be happy to have a chat with you about fees, even if it’s just to provide you with some guidance and certainty around your current negotiation efforts.

A better question you should ask is. What price am I prepared to pay to achieve the things in life most important to me?

Really great question Peter