Banner image by Zain Ali via Pexels

If you’ve ever felt frustrated with your superannuation fund because you feel like you have no control over your money, limited access to information, no feeling of ownership and you are at the mercy of the share market with your superannuation investments, then you’re not alone.

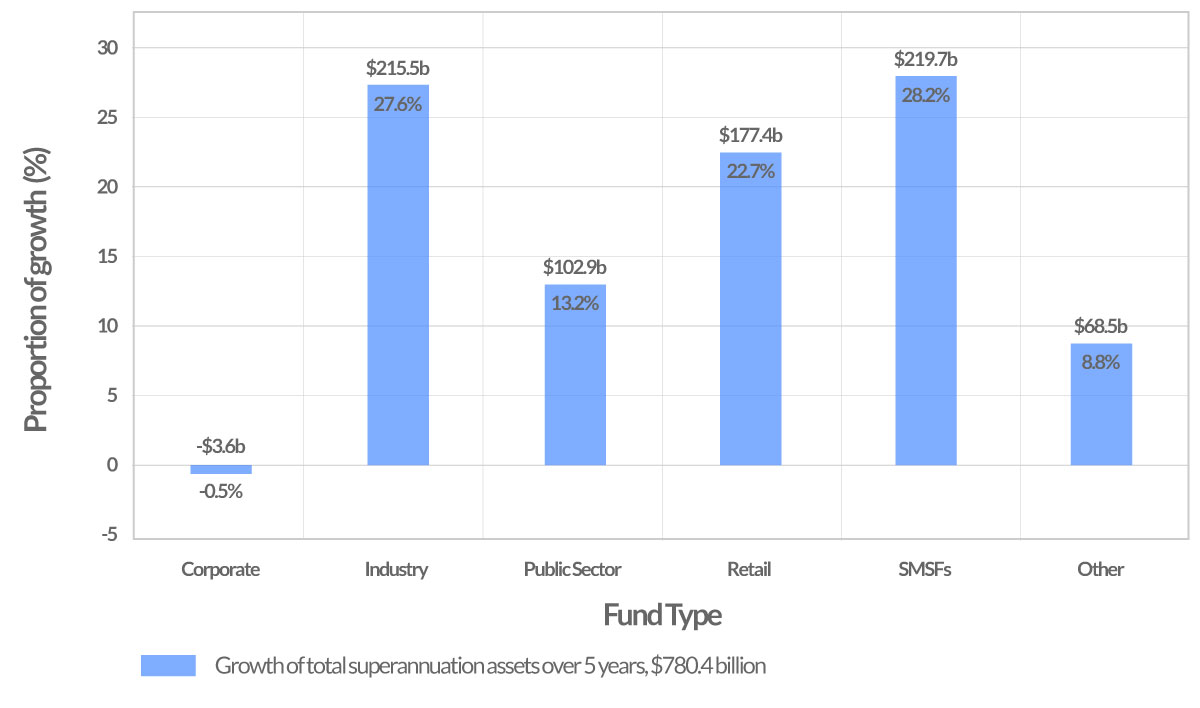

There has been a big shift in superannuation in Australia over the last ten years towards Self-Managed Superannuation Funds (SMSFs).

SMSFs now hold close to one-third of total superannuation funds. SMSFs are often the preferred choice for people who are highly engaged with their superannuation and seen by many as providing a solution to the above-mentioned superannuation frustrations.

While a lot of people have heard about SMSFs and the benefits involved, when it comes down to it, they often don’t really know all that much about SMSFs or their current superannuation for that matter. Adrian McPhee – Financial Advisor Click To TweetYou might have even wondered yourself whether an SMSF is a better option for you with your superannuation, but you may not have been able to find the right information to give you an answer.

In this article, we will examine:

- the main benefits of an SMSF;

- the key benchmarks when SMSF becomes attractive; and

- important things to be aware of before setting up an SMSF.

Although this article is designed to give you a good overview of SMSFs, it is not intended to provide an exhaustive list of all the benefits and nor is it intended to provide a blueprint of sorts for making changes to your superannuation.

If after reading this article, you think you’re in a position to set up an SMSF and you’re interested to explore the option further, then you should arrange a meeting with a qualified financial advisor who can examine your situation to ascertain whether or not an SMSF is appropriate for your circumstances.

Main Benefits of an SMSF

1. Greater Control over your SMSF Investments

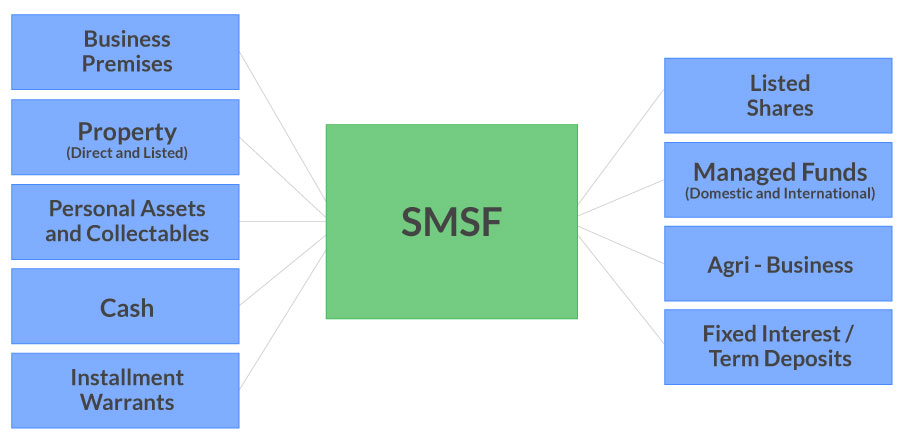

SMSFs provide you with more control over your money than any other type of superannuation fund. Not only can you invest in a broader range of asset classes, such as cash, fixed interest, property, shares, managed funds etc, you also have greater transparency with your investment strategy because you are able to see exactly what you’re invested into rather than receiving a statement every six to twelve months with a pie chart that depicts generic investments in various markets and asset classes (e.g. domestic shares, international shares, infrastructure etc).

It follows that, with this increased control in an SMSF, you are also able to achieve greater diversification with your superannuation investments as you have more options at your disposal.

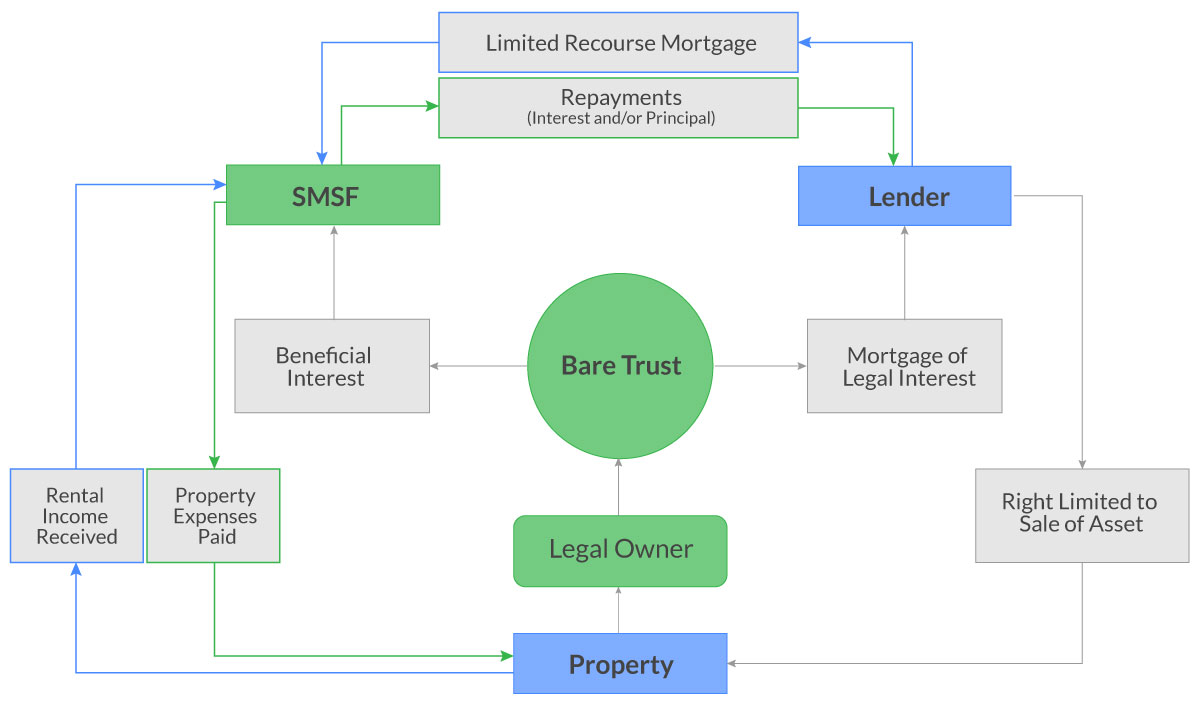

2. An SMSF can Borrow Money to Invest

The ability to borrow money in an SMSF via a limited recourse borrowing arrangement (LRBA) means that you are able to use the power of leverage in your superannuation. It is true that you can also leverage in some traditional superannuation funds into shares and managed funds; however, SMSF is the only type of superannuation fund where you can borrow money to invest in direct property, which is a much more secure asset class for borrowing purposes because banks look more favourably on bricks and mortar.

Not only does this give you the opportunity to control a larger asset base than you would otherwise be able to control in your superannuation, but it also provides you with the opportunity to establish a geared investment property portfolio inside your superannuation in much the same way as you would in your personal finances, albeit with some restrictions which are covered below.

3. You can combine superannuation balances to give the SMSF members a larger capital base to Invest

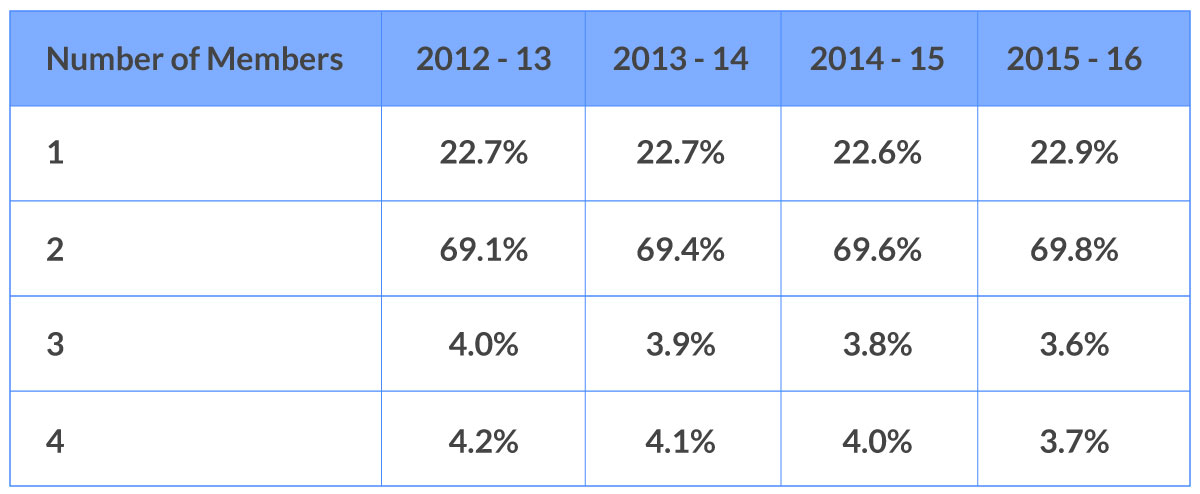

An SMSF allows you to have up to four members in the fund, so combining your superannuation with other parties can reduce the number of fees that you are paying.

Approximate distribution of the number of members in SMSFs sourced from the ATO

It’s important to point out that this does not necessarily mean that an SMSF will be cheaper to run, but it does reduce the number of separate fees being paid which usually yields some efficiencies. Furthermore, combining balances also gives the fund’s members a larger capital base to work with which can open the door to investment options and strategies that would otherwise be unavailable.

4. An SMSF has a Flat-Fee Structure

An SMSF is administered each year by an accountant so it is an accounting-based fee that is charged which is usually a flat-fee. An accountant is generally not concerned whether there is, for example, $300,000 or $400,000 in the fund, if the same amount of accounting work is involved, then the fee will usually be the same.

The Flat-Fee Structure in SMSF is in stark contrast to traditional superannuation funds where a percentage-based fee is charged. And the problem with a percentage-based fee is that you continue to pay more in fees just because your superannuation balance increases. Simon Grewal - AccountantClick To TweetIt follows that an SMSF becomes an increasingly cost-effective option with the more money you have in superannuation because the fee doesn’t scale the same way as it does when a fee is percentage-based.

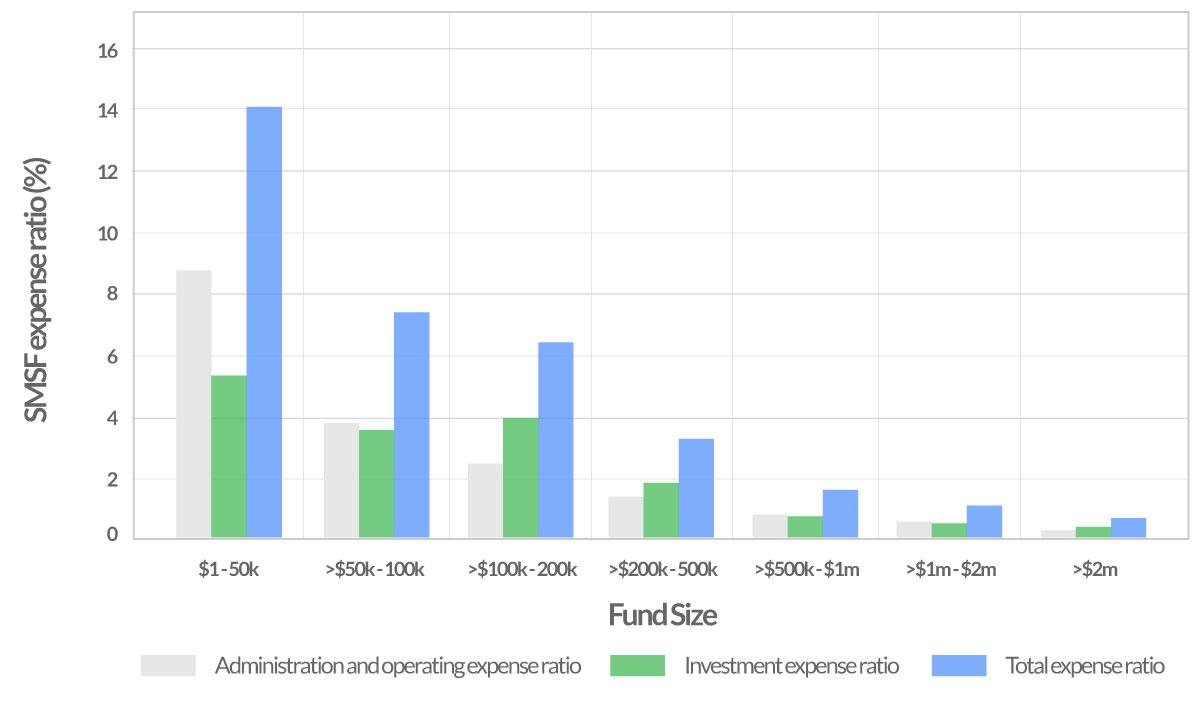

This graph from the ATO shows 2016 SMSF expense rations by fund size. Ratios generally decline in direct proportion to the increase in fund size.

5. SMSFs are increasingly tax efficient when compared with traditional superannuation funds

All superannuation funds enjoy the standard tax efficiencies that come from the concessional status bestowed on superannuation; however, SMSFs are increasingly tax efficient when compared with traditional superannuation funds.

Not only can SMSFs enjoy tax efficiencies from timing contributions to defer contributions tax, interest deductions from borrowing money and depreciation allowances when investing in property, but an SMSF is also extremely tax efficient come retirement because assets can be segregated to specific members rather than forming part of a pooled investment strategy as is the case in traditional superannuation funds.

In a practical sense, what this means is that an SMSF can rollover funds from accumulation phase to pension phase without having to sell down its assets beforehand. It follows that the SMSF’s assets can then be sold in pension phase which has a tax-free status up to $1,600,000 per member and, as such, CGT liability can be avoided. This can represent a significant tax saving in SMSF that is not available with pooled investment strategies and it can have a material impact on your total retirement savings.

6. SMSF Trustees are found to be Better Engaged with their Superannuation

According to the 2014/15 Superannuation Benchmarking Study conducted by Engaged Marketing, Australians are more likely to be engaged and satisfied with their Self-Managed Superannuation Fund (SMSF) than they are with traditional superannuation funds.

There are several factors that contribute to this conclusion, but the practical reality of having more control, greater transparency and increased responsibility means that having an SMSF encourages fund members to be more proactive with their superannuation as there is a greater sense of ownership, value and purpose involved.

7. Tax deductions can be passed onto SMSF family members

Increased flexibility within an SMSF means that substantial tax deductions can be passed onto SMSF family members through strategies like Future Service Benefit Deduction.

This applies in the event of death or disability which causes a member under the age of 65 to terminate their employment. In this instance, rather than claiming a tax deduction for the payment of Life or TPD premiums in the current financial year, an SMSF can elect to claim a deduction for the future liability to pay the death or disability benefit in the year that it is paid.

Depending on how far away the member was from age 65 at the time of death or disability, this deduction can be very substantial, and it is capable of being carried forward to future financial years for the benefit of other members in the SMSF who are still in accumulation phase.

8. SMSF members have more tools at their disposal to transfer wealth to the next generation

Australia’s superannuation system enjoys many useful estate planning benefits; however, the control and flexibility available to members in an SMSF means that they have even more tools at their disposal than traditional superannuation account holders.

Firstly, it is more common for members in an SMSF to have a non-lapsing binding death benefit nomination as it is usually included in the scope of work when the fund is set up. Low-cost online SMSF set up providers may not include this in their service offering, so it’s important to do your homework before engaging anyone in the first place.

SMSFs have greater flexibility when it comes to distributing assets. For instance, an SMSF can leave taxable pensions to dependants on a tax-free basis, or on a mostly tax-free basis for non-dependants. Sunny Ramesh - Paraplanner Click To TweetAn SMSF lets you structure tax effective income streams for dependents rather than providing a lump sum payment which can be particularly useful if you are leaving money to a young child or other beneficiaries who would struggle to manage the distribution properly if they received it as a lump sum.

Key benchmarks when SMSF becomes attractive

In accordance with ASIC guidance[1], $200,000 is the balance where looking at an SMSF as an option for your superannuation becomes worthy of further investigation.

For lending purposes, as of late 2017, you definitely want a minimum of $200,000 in combined balance otherwise you cannot deal with most mainstream lenders for SMSF lending (LRBA) and alternative lenders usually have higher interest rates.

In addition, to make an SMSF strategy work most effectively, you ideally want healthy contributions going into the fund each year to provide appropriate liquidity for investment and insurance purposes.

Anything less than $12,000 p.a. is probably not ideal, but it must be noted that this is a generalisation and the amount of contributions needed also depends on your balance and a variety of other factors.

[1] Information Sheet 206 Advice on self-managed superannuation funds: Disclosure of costs, http://asic.gov.au/regulatory-resources/financial-services/giving-financial-product-advice/advice-on-self-managed-superannuation-funds-disclosure-of-costs/Important things to be aware of before setting up an SMSF

1) Even if you have a financial advisor, as the trustee of the fund, you are ultimately responsible for what happens in your SMSF.

2) All investments in an SMSF must meet the sole purpose test (i.e. they must be held in the fund for the sole benefit of your retirement). It follows that you cannot live or take holidays in a property that is purchased by your SMSF or make use of rare art or other collectibles that are owned by your SMSF.

3) Lending rates are generally 1% to 1.5% higher in SMSF than they are outside superannuation.

4) You cannot use the equity in an investment property owned by your SMSF to borrow for another investment property. Moreover, the only way that an existing investment property in an SMSF can assist with borrowing to buy another investment property is through the rental income that the first investment property derives for servicing purposes.

5) You are allowed to repair and maintain an asset that is owned by an SMSF, but you cannot make capital improvements to any assets. For example, if you own an investment property in your SMSF and you have granite benchtops throughout your investment property that need replacing, you cannot put marble benchtops in place that are significantly more expensive and increase the value of the property. It follows that you also cannot add additional bedrooms or put an extension on the back of your investment property while it is owned by your SMSF as all of these examples would amount to a capital improvement to the asset.

6) As trustee, you will have access to your SMSF’s bank account, but, with limited exceptions[2], you are not allowed to withdraw money from the SMSF account (not even temporarily) while you’re in accumulation phase as this is a breach of the governing legislation and can incur severe penalties.

7) In accordance with the governing legislation, you must at least consider insurance cover within your SMSF to ensure that you are appropriately protected.

8) There are some service providers that offer low cost SMSF set up options, but, unless it’s a single member SMSF, most of these do not involve the use of a corporate trustee which means that you will have to act as individual trustees. This does not provide you with the same level of asset protection as a corporate trustee and, among other things, it can create significant succession issues if a member of the SMSF dies or becomes legally incapacitated.

[2] Accessing super early: 14 legal ways to withdraw your super benefits, https://www.superguide.com.au/accessing-superannuation/legal-ways-to-withdraw-your-super-benefitsBenefits aside, if you are thinking of setting up an SMSF, you need to do your research

There are significant benefits that SMSF has when compared with traditional superannuation funds. However, if you are thinking of setting up an SMSF, you need to do your research in the first instance and go into it with your eyes open because there are details which make it more complicated than traditional superannuation funds.

It follows that having an SMSF is not for everyone, but, if you’re comfortable with being a little bit more hands on with your superannuation and you like the idea of having greater control, transparency, broader investment options, increased tax efficiency and access to the power of leverage, then it is a platform that provides you with the opportunity to tailor your superannuation strategy to meet your investment preferences and take control of achieving your retirement goals and objectives.

Want to discuss SMSF in the context of your personal circumstances with a Financial Advisor?

[…] of the most important ways you can strengthen your financial position come retirement. There are benefits to an SMSF versus traditional superannuation funds, however, the extent of these benefits is dependent on your financial position, investment […]

It’s good to know that other people who have dealt with superannuation prefer to use SMSF for their funds. I think small businesses and people, in general, should try and work with an SMSF adviser because they can really help them understand their superannuation. I hope that people who get frustrated with superannuation are able to use SMSF to their advantage so that everything is easier for them.

Not many people realize the benefits that a SMSF can give them, but you have to know how to get it going first. The article brings up a particularly good point about how each investment needs to pass the sole purpose test. After all, you will want to make sure all of your investments are viable while you work on your SMSF.