Where do you start when choosing a financial advisor? And what should you expect from them?

When all financial advisors are legally bound to provide advice in your best interests*, how do you determine who is a capable financial advisor and who will be a good fit for your financial needs and circumstances?

*A legal requirement of the Future of Financial Advice (FOFA) legislation

The basic checks to perform before choosing a financial advisor

Firstly, before choosing a financial advisor to add to your shortlist there are some basic checks you should perform. Each of these checks can be completed online with relatively little effort:

- Is the financial planning firm licenced to provide advice?

Click here to check ASIC Connect Professional Registers - Is the financial advisor registered to provide advice?

Click here to check the Money Smart Financial Advisors register - Is the firm and the advisor approved to provide advice on the services you are seeking?

Check the company Financial Services Guide which can be found on their website - Are the financial advisor fees affordable?

Check their company website for advice costs, if a company is vague on costs you may need to call

Although the above details are relatively easy to find, many financial advice seekers will overlook these basic checks before choosing a financial advisor.

[hcode_accordian accordian_pre_define_style=”toggles-style3″ accordion_preview_image=”toggles-style3″ without_border=”1″ accordian_id=”1519614220″][hcode_accordian_content accordian_title=”Wealth Seekers Licencing and Registration Information”]Company: Wealth Seekers Financial Services Pty LtdCompany Licence: AFS Representative Number 001259408

Financial Advisor: Adrian McPhee

Financial Advisor Licence: Financial adviser/authorised representative number given by ASIC. 001000251

Products and Services provided: Click here to view the Wealth Seekers Financial Services Guide

Cost of Services: View the Financial Advisor Fees

Memberships and Associations: Association of Financial Advisors, Tax Practitioners Board, Self-Managed Superannuation Fund Association[/hcode_accordian_content][/hcode_accordian]

When you have narrowed down your search to the financial advisors you would like to meet with, the following information will help you work through the more subjective areas of choosing a financial advisor who will be a good fit for your financial needs and circumstances.

Before requiring a financial commitment from you, a Financial Advisor should take the time to ensure that you understand the advice being provided and the benefits you’ll receive.

Adrian McPhee – Financial Advisor

Beginning with an no cost, no obligation initial appointment, which most financial advisors offer, will allow you to get to know the advisor and their business while also giving them a chance to get to know you.

1. Determine if a financial advisor can speak your language

It is important to be able to trust your financial advisor and be comfortable with the advice that they provide, and the way in which they explain it. You also need to be willing to engage the advice process and accept financial planning recommendations, so good communication is essential.

A financial advisor should exhibit the following characteristics:

- Identify with your circumstances and take the time get to know your story

- Display a genuine interest in improving your finances and securing your family’s future

- Before requiring a financial commitment from you, takes the time to ensure that you understand the advice being provided and the benefits you’ll receive

- Communicates with you in a way that is uncomplicated and helps you to understand what will be required for you to achieve your goals

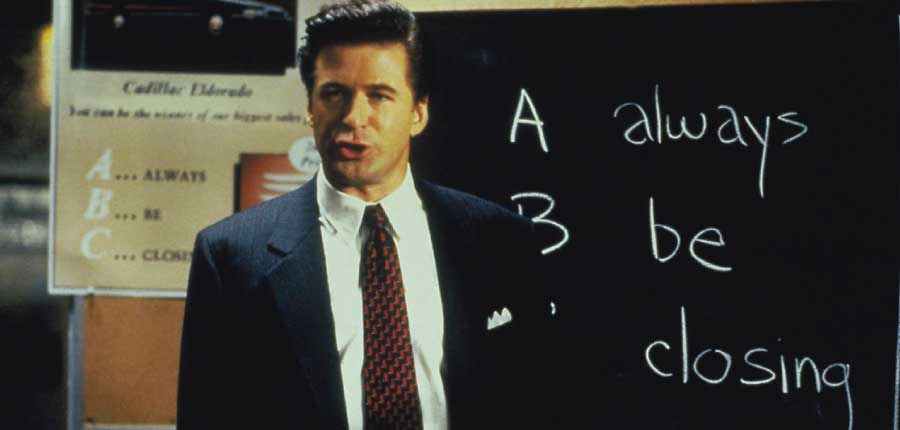

2.Determine if a financial advisor is putting their KPIs ahead of your financial goals

It is your financial advisor’s responsibility to make clear recommendations you are comfortable with and ensure that you fully understand the advice you are receiving, as well as any costs and risks involved.

- This means having a good understanding of how your advisor is remunerated

- This does not mean feeling pressured to accept advice, product recommendations or services you are not comfortable with

If you feel the advisor is intentionally vague on details or you don’t understand what is being communicated, then you should ask the advisor for further clarification.

Alarm bells should start ringing if your financial advisor:

- Fails to take time to learn about your individual circumstances, needs and goals

- Is more interested in selling you a product than developing a strategy for you

- Promises you the world (e.g. high returns with low risk) and tells you not to worry

- Avoids questions or withholds information

- Is consistently difficult to get into contact with

- Is not clear about fees and charges, or their fees appear excessive.

Be wary of choosing a financial advisor who is not cost conscious with your financial advice or investment selections

If you are paying unnecessary and/or excessive fees, you need to earn a higher investment return to achieve the same after-fee investment value (or standard of living in retirement) than you otherwise would with a low-cost alternative. Be wary of exorbitant upfront or ongoing advice fee, as paying too much can be extremely detrimental to your long-term financial performance and often points to a strong self-interest from the advisor to secure your business.

If you feel the advisor is intentionally vague on details or you don’t understand what is being communicated, then you should ask the advisor for further clarification.

Ryan Wood – Property Advisor

If you meet with a financial advisor and, at the end of your appointment, something still doesn’t feel right, then a great question to ask is: ‘How will you help me reach my goals?’ The answer will quickly tell you whether an advisor is a good match for you because he or she should have a good understanding of your goals and be able to clearly articulate the financial plan in mind before putting anything into action.

3. Determine the Capability of a Financial Advisor

In addition to a personal connection, a good financial advisor has a leading role to play in the improvement of your financial position, so the following areas are a must when determining the suitability of the advisor and whether he or she is a good fit for your needs:

- Appropriately licenced and qualified to provide advice on the specific areas that are important to you (see above )

- Has knowledge and experience with providing advice to clients with similar needs and requirements as yourself

- Communicates financial concepts and strategies without jargon and in a way you understand and that’s relatable to your personal circumstances.

- Demonstrates a thorough understanding of the financial services industry, professional standards and the prevailing legislative environment. Keep in mind, however, that legislation and financial markets are constantly changing so you also want an advisor who understands current events and their potential impact on your financial plan

- Is a member of an association such as the Association of Financial Advisors (AFA) or Financial Planning Association (FPA). Members must adhere to a code of conduct, ethical standards and undertake continuous education. In addition, new practitioner members of the AFA must have a relevant university degree.

4. Determine if a company’s policies conflict with your needs

Where an organisation is limited to a specific bank or institution’s suite of products or their pricing model appears expensive, the connection you have with the advisor and their capabilities may not make up for financial planning that is not cost effective or which has not considered a range of strategic options. To protect yourself, you should ask the following questions:

- Is the advisor happy to consider all potential strategies and investment options and assess them on their own merit?

- Not everyone needs financial advice, some will have personal finance areas that are already performing well, and in a cost-effective way and only need limited advice. Where an advisor is trying to convince you otherwise, you should ask why?

- Is an advisor encouraging you to take on uncomfortably high levels of debt to invest, pushing alternative investment options, recommending excessive insurance cover or providing a financial plan that makes you goals contingent upon future financial performance?

- Some goals are just unrealistic, and others are less attainable when considered against your current resources and financial commitments. It is not your advisor’s role to set unachievable expectations just to win your business. If you feel this is the case, ask yourself whether your advisor act objectively?

- It is important to note, advisors work for firms with different business models. While some people like the comfort of a big brand, such as a major institution, ask yourself whether they are just there to sell their own financial products?

- Does the company predominantly work with a specific type of client? If you find your current personal circumstances or finance situation differs from the norm that a company usually works with, the value an advisor is able to provide you may be rather limited.

Shop around for financial planning

People will spend weeks researching the perfect flat screen TV… scouring catalogues, hunting through online reviews, visiting stores and talking to friends before making their final decision. Yet, when it comes to financial planning, a lot of people will choose a financial advisor before seeking a second opinion on their financial plan or the financial advisor fees involved.

Taking your time when choosing a financial advisor is worth the effort.

A good finanical plan can add significant value to your financial situation by:

- Helping you to set and achieve your financial goals

- Ensuring that you make the most of your money

- Securing government assistance that you’re entitled to

- Enabling you to take control of your finances and live the life you want to live

- Guiding you to avoid expensive mistakes

- Assisting you to protect your assets

Like any other purchasing decision, it is worthwhile shopping around to see what options are available before establishing a relationship with a financial advisor because it may well be one of the most important financial decisions you ever make.